XAU/USD (gold price in terms of USD) ended a 2-day climb and dropped on Friday from near $ 1240 mark, booking the first weekly loss in more than a month, as the resurgence of risk-on environment combined with broad USD strength underpinned the precious metal. However, the downside remained capped on the back of dwindling bets of further Fed rates rises this year and also as gold to oil ratio hit record-highs last week. Data-wise, the upbeat US CPI figures also added to the positive sentiment around the greenback, and thus, weighed heavily on the bullion. The CPI was unchanged in January, rather than showing a 0.1% decline as expected by the market. While the core figures outpaced expectations and hit a 3.5 year high in last month.

At the moment, the gold prices are seen trading in the lower-bound of today’s trading range near daily lows reached at 1211.70. The prices dropped for a second day today after a renewed bout of optimism hit markets following sharp gains seen on the Asian stocks alongside oil and industrial metals. Further, the persistent favourable risk environment continues to lend support to the risk currency USD, with the DXY higher to the tune of +0.36% at 97 levels. In the day ahead, the second-liner data in the form of the US flash manufacturing PMI will be reported, which is likely to have limited data on gold. Hence, the risk remains to the downside going forward as the greenback is likely to remain strongly bid amid risk-on market profile.

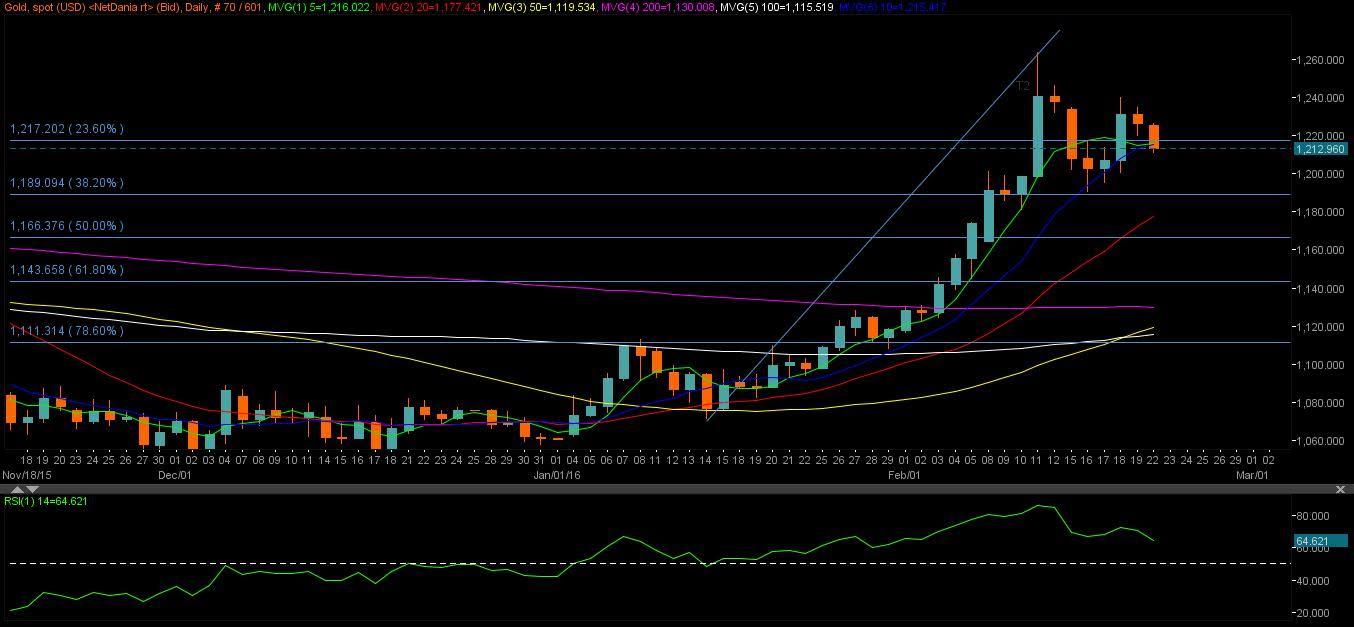

Technicals – Breaches key support near $ 1215

On daily charts, the prices are seen breaking lower, breaching a strong support placed ahead of 1215 levels, the confluence of 5 & 10-DMA. The daily RSI aims sharply lower near 64, suggesting further room for declines. Hence, to the downside, the prices find the immediate support at 1200 levels, convergence of Feb 18 low and the key psychological levels. A break below the last, the prices could head for a test of $ 1190 – Fib 38.20% support (retracement of Jan 14 low-Feb 11 high). On the flip side, if the prices manage to resist $ 1200 mark, a rebound could be expected towards the support-turned resistance located near 1215 levels and from there to daily highs printed at 1226.26.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.