The XAU/USD pair (gold prices in terms of the US dollar) reversed previous gains and ended in the red on Wednesday at 1145.25, just ahead of the 100-DMA support then located at 1143.22. The pair failed once again near the falling trend line resistance and hence did not trigger a symmetrical triangle bullish break out on closing basis. The prices jumped from fresh two-week highs of 1153.74 and dropped to as low as 1141.88 levels after the US dollar managed to recover some lost ground amid a data-deficient US macro calendar. Moreover, the gains on the global equities also dulled gold’s appeal as an alternative yielding asset.

As for today’s trade so far, XAU/USD extends its bearish bias, although managed to regain the 100-DMA barrier now located at 1142.60. Markets resorted to profit-taking after the recent run of gains, repositioning ahead of the key FOMC minutes, which further dragged gold prices lower. Later in the day, the US weekly jobless claims are expected to have minimal impact on the bullion as the main focus remains on the Fed minutes, which might set the tone for gold prices until the Oct 28 Fed meeting. FOMC minutes are largely expected to be read as dovish after the Fed at its Sept 17 meeting refrained from raising rates and raised worries over the global economic outlook.

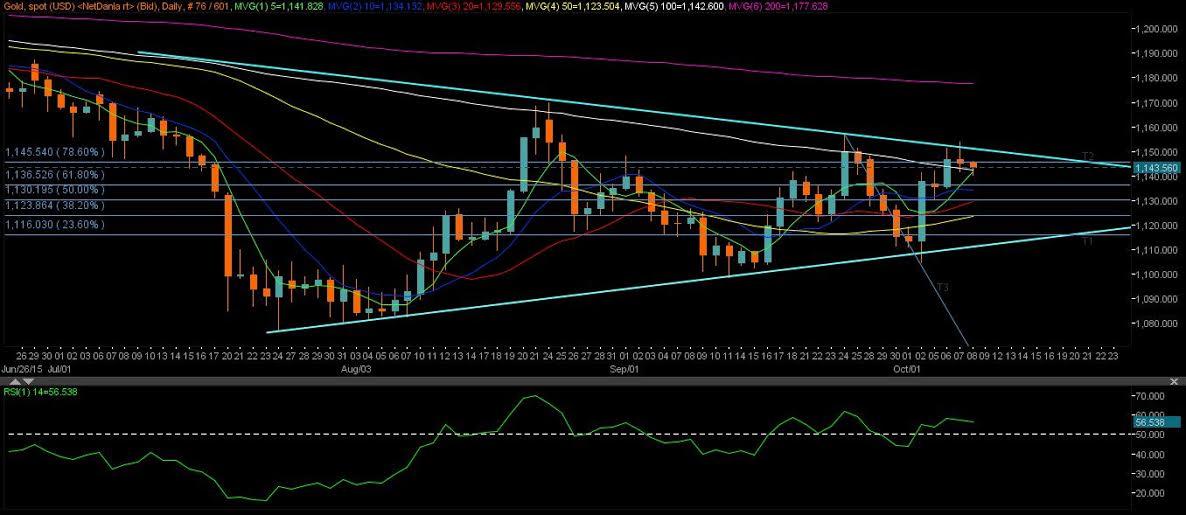

Technicals – a symmetrical triangle bullish break out on dovish Fed minutes?

On daily charts, the prices slipped below the Fib 78.60% resistance (last week’s fall) located at 1145.54 and found support at 1140 – psychological levels and extends its recovery beyond the 100-DMA. The daily RSI now around 57 has turned slightly flatter, suggesting correction seems over and the prices could swing back high. Should the Fed minutes turn out be more dovish then expectations, the prices could accelerate to the upside and retest the falling trend line resistance placed now placed at 1151.02, beyond which the next barrier at 1156.70 (previous highs) could come into the picture.

To the downside, a less dovish surprise could offer some temporal support to the USD bulls and drag prices the pair towards the key Fib 61.80% support located at 1136.52, below which the confluence zone of the 20-DMA and Fib 50% of the same decline near 1130 could be tested. Overall, a generalized intraday upside bias persists for the bullion amid expectations of a dovish FOMC minutes.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.