The XAU/USD pair (gold prices in terms of the US dollar) dropped for the second day in a row on Friday, although booked second weekly gain. The prices fell nearly $ 10 after the greenback swung higher after the US consumer sentiment rebounded from an 11-month trough. The UoM preliminary Consumer Confidence Index booked 92.1 points during Oct, compared to the final 87.2 seen in September. While the industrial figures from the US matched estimates (-0.2% in Sept). Moreover, the uncertainty over the Fed rate hike timing amid mixed US economic news also kept the bullion undermined. The prices breached the 200-DMA then located at 1176.50 and fell as low as 1174.37, before regaining 200-DMA at close.

As for today’s trade in running, XAU/USD is seen consolidating the last week’s rally to fresh multi-week highs for the third straight session, making for a weaker start to this week. The prices received a fresh blow from the latest Chinese data, with the above estimates GDP data failed to impress the gold traders. Moreover, weak industrial production and fixed assets data from China further added to the ongoing weakness in the economy and raised worries over the demand for gold from the world’s largest bullion consumer. Later in the day, the trading book is expected to remain light as there is nothing relevant in terms of economic data lined up for release. While the pair may take fresh cues on the rate outlook from the Fed officers’ speeches due later in the New York session. FOMC Member Brainard is due to deliver a speech at the Chicago Fed's outreach meeting. While Fed Member Lacker is scheduled to speak at the University of Richmond.

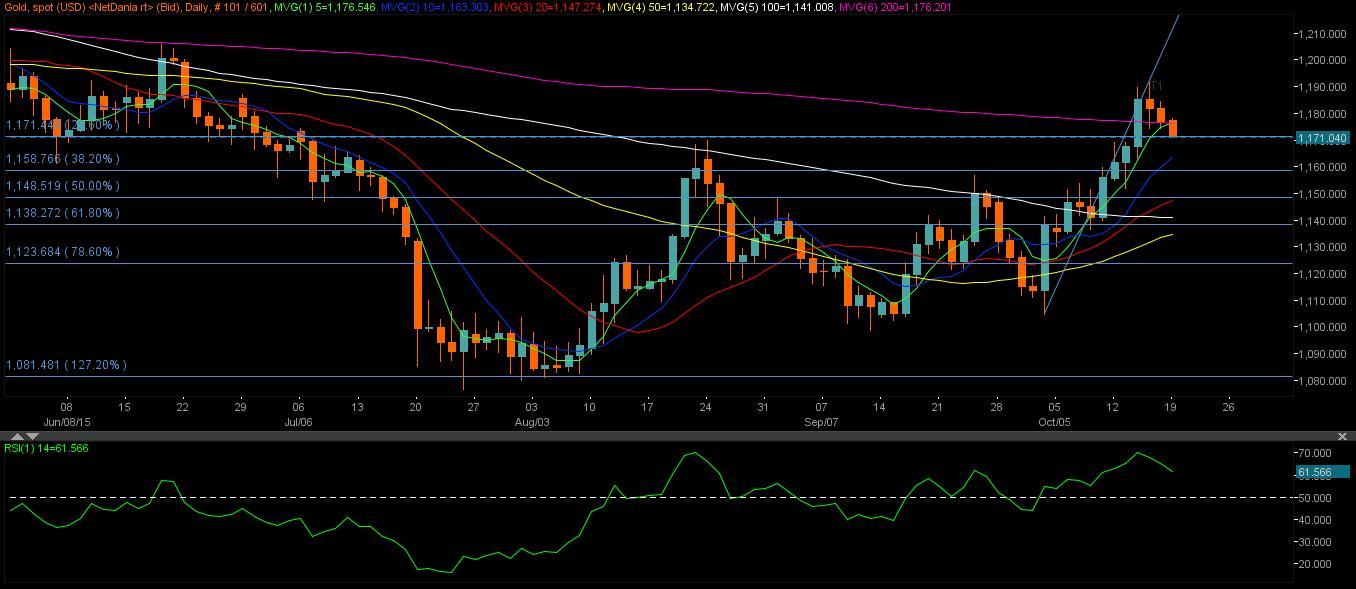

Technicals – A break below Fib 23.60% (Oct 2-15 rally), could expose $ 1160

On daily charts, the prices are seen clinging to the Fib 23.60% (Oct 2-15 rally) support placed at 1171.07, with bearish pressures likely to extend further amid returning risk-sentiment on rising European equities. The daily RSI hovers around 61 and points south, supporting the case for further declines. Hence, a breach of the last support, the prices could drop to the upward sloping 10-DMA located at 1163.38, which also coincides with the horizontal hourly 200-SMA. A fresh sell-off could be triggered below 10-DMA levels sending the prices towards the Fib 38.2% retracement of the same rally located at 1158.39.

However, a failure to breach the critical support near 1163 region, the prices could rebound higher towards the 200-DMA now located at 1176.20, beyond which doors would open for a retest of 1185-1190 – multi-week tops. Overall, a generalized intraday downside persists today as markets will continue to assess the Chinese data amid a better risk environment.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.