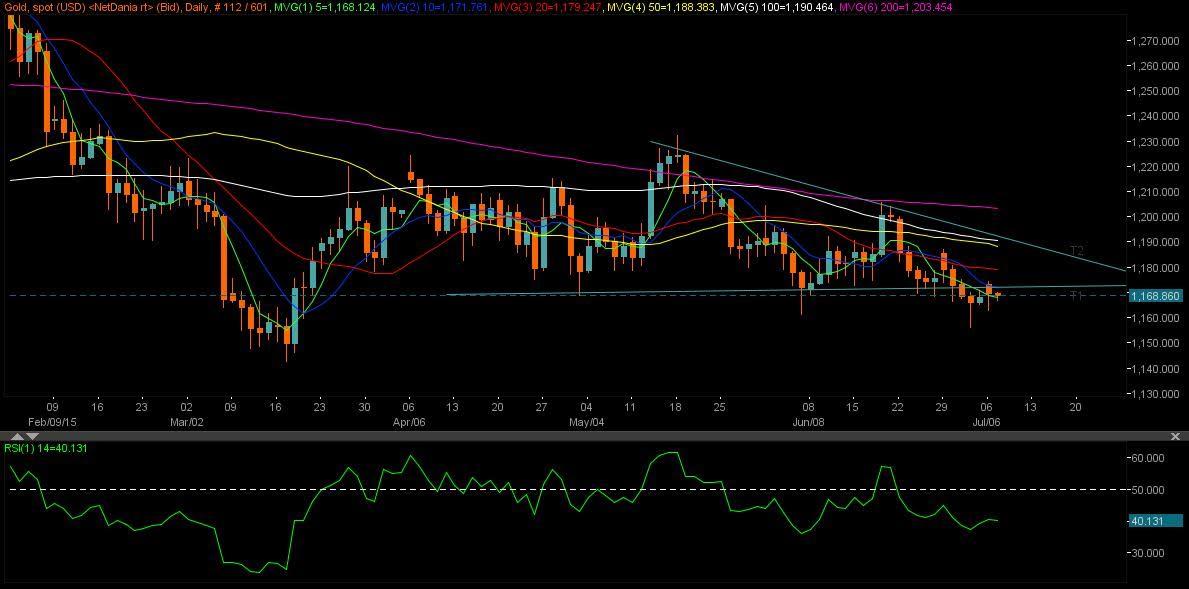

XAU/USD pair – Daily Chart

Gold prices in terms of US dollar (XAU/USD) reversed previous gains and settled lower on Monday at 1169.43 levels, recovering from 1162.82 lows. The pair dropped nearly $ 12 from 1174.46 highs in the previous session largely on the back of strengthening US dollar, which was boosted by tumbling euro following the NO vote victory at Greek referendum while upbeat services sector data from the US also supported the USD bulls, knocking-off XAU/USD lower.

XAU/USD extends its weakness today and trades below 1170 levels as the US dollar strength dominates across the board as markets remain cautious and favour the reserve currency ahead of key Euro group meeting with Greek bailout or possible Grexit on top of the EU officials’ agenda. While US trade figures and JOLTS job opening may further boost the greenback. Hence, the pair is likely to extends declines and could retest 1162.82 (July 6 Low) below which floors will open for a test of 1156.01 (July 2 Low) levels. The daily RSI hovering around 40 has also turned lower, indicating further southward moves likely. While the upside seems limited and restricted to the triangle support-turned resistance and 10-DMA confluence located at 1171.70.

XAU/EUR pair – Daily Chart

Although, gold prices in terms of Euro (XAU/EUR) displayed a triangle breakout to the upside, the XAU bulls failed to defend gains and dropped sharply on Monday, finally ending the day below 1050 levels. The pair witnessed losses despite EUR/USD weakness, largely on the back of generalized selling seen in XAU pairs fuelled by stronger US dollar. While looming Greece concerns keep the pair supported.

As for today’s trade, XAU/EUR opened with a bullish gap and extended gains, riding higher near 1160 levels. The pair seems to trade in a narrow range, locked between 50-DMA placed at 1063 to the upside and the downside cushioned by 5-DMA and triangle resistance-turned support confluence located at 1056-1055 levels. In the day ahead, XAU/EUR is expected to remain buoyed on safe-haven demand as traders remain wary before the upcoming Euro group meeting alongside the Euro Summit with mostly a Grexit to be evaluated by the Euro group minsters. The euro is expected to remain pressured amid Greek talks while ECB’s tougher stance on Greek banks announced yesterday also keeps the shared currency undermined, thereby boosting XAU.EUR somewhat.

Technically, the daily RSI trades just above the mid line in the bull range and now seems to have turned flatter, suggesting a wait and see approach by the markets. Moreover, XAU/EUR is almost forming a small doji on daily charts which too points out to lack of clear direction. To the upside, the pair is likely to test 50-DMA, above which Monday’s high at 1067.09 comes into the picture. While to the downside, a break below the crucial support zone at 1056-1055, selling pressure may intensify dragging the pair lower to the 20-DMA support at 1052 levels and from there to 1050 – psychological levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.