The drop in prices makes Gold an under performer among the group of traditional safe haven assets. The US 10-year Treasury yield has dropped from 1.95% to 1.87%, while the Japanese Yen too has gained from 120.82 per USD to 119.33 per USD.

All round disappointment ignored...

Beginning with the IMF forecasts – The downward revision of the US 2015 GDP forecast by the IMF failed to a have any significant impact on Gold. The metal did rally briefly to USD 1207-1209 levels, however, the gains were quickly erased.

Low Chinese growth ignored – China reported first quarter GDP at a six year low today. Gross domestic product (GDP) grew an annual 7.0% in the first quarter, slowing from 7.3% in the fourth quarter of 2014. The IMF also warned that the Chinese economy could see more slowdown in the near future. Still, Gold prices continued to fall, hitting a low of USD 1188.6/Oz today.

Turned a blind eye towards Greece - The IMF warned that the negotiations are falling apart but Greece was quick to deny the risk of a default. According to “EU officials,” they most likely will not approve Greek reforms when they meet on April 24 and that the earliest they could reach a deal will be at the May 11 meeting. However, Greece needs funds before May 1 as the IMF loans are due on May 1. Thus, possibility of Greece defaulting on its loans has increased multifold.

There is also a possibility of Greek PM calling elections, in which a strong majority to Syriza, would increase the possibility of “Grexit”. EU officials have termed Greek reelections as a sort of referendum on whether to stay in the Eurozone or not.

Disappointing US data – The advance retail sales for March printed weaker-than-expected on Tuesday, while the Industrial production fell to lowest since August 2012.

Despite all the gloom, the metal is down 1.23% so far in the week. The metal could be pricing-in a US rate hike in 2015.

IMF’s downward revision of US GDP a confirmation of a rate hike?

The US dollar made a strong comeback in the European session today, after suffering a sell-off in the previous session on IMF’s bearish GDP forecasts. Moreover, the downward revision of the GDP did not result into significant fall in the 2-year yield in the US, which mimics short-term interest rate expectations. Meanwhile, the 10-year yield fell from 1.94% to 1.87%, although the safe haven demand due to Greece issue could have been at play behind the fall in the long-end yields.Despite the downward revision, the US is set to grow at 3.1% this year and next year. So a slash from 3.3% to 3.1%, may have been due to prospects of rate hike in 2015. The action in the Treasuries does indicate that this could have been the reason, since the 2-year yield has stayed relatively resilient, dropping from 0.55% to 0.504% today. It is worth noting, that we also had weak advance retail sales and industrial production data, despite which the 2-year yield has stayed resilient.

Thus, Gold, which is highly sensitive to US rate hike prospects, could have stayed weak on increased prospects of rate hike after the IMF’s downward revision of the growth forecasts. Given the metal has under performed so far, any relief on Greece issue is likely to weigh over the metal heavily. Meanwhile, the strength in the USD would continue to weigh over prices.

Technical Factors

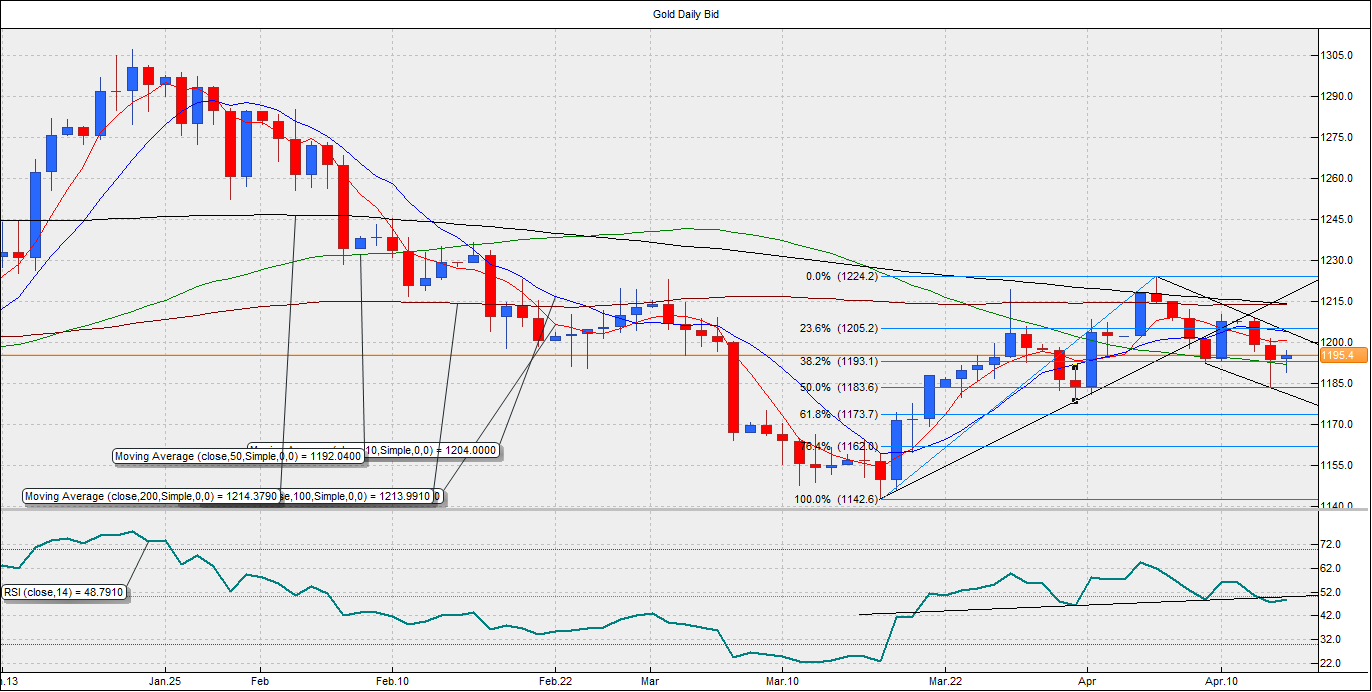

The daily chart shows, the metal is trading in a downward channel after having breached the rising trend line on Monday.

So far the metal has been able to sustain above its 50-DMA, although immediate gains appear capped at 1195.8 (channel resistance), followed by resistance at 1205.1 (23.6% Fib retracement of 1142.6-1224.4). The metal is likely to witness selling pressure so long as it trades below USD 1205.1.

Meanwhile, immediate support is seen at 1183.5 (50% Fib retracement of 1142.6-1224.4) and 1181.3 (falling trend line support). The daily RSI has turned bearish after breaching the head and shoulder pattern.

The metal is more likely to extend the drop to USD 1181.3-1178.5 by the weekend.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.