Today’s AM fix was USD 1,336.25, EUR 968.79 and GBP 825.76 per ounce.

Yesterday’s AM fix was USD 1,333.00, EUR 968.68 and GBP 825.13 per ounce.

Gold fell $6.90 or 0.51% yesterday, closing at $1,333.30/oz. Silver slipped $0.12 or 0.53% closing at $22.56. Platinum rose $2.94 or 0.21% to $1,433.24/oz, while palladium fell $1.50 or 0.20% to $742.50/oz.

Gold inched up in London as the dollar fell to a two year low against the euro. The yellow metal is on track for a four week high, as investors buy precious metals on increased safe haven demand. Gold Krugerrands (1 oz) are trading at $1,403.75 or premiums between 4.75% and 5.5% and Gold Kilo Bars (1 kilo) are trading at $44,354.53 or premiums between 3% and 3.5%. Premiums are holding steady.

The poor economic data published recently in the U.S. is signalling that the economic recovery is on shaky ground, and this has increased the allure of bullion.

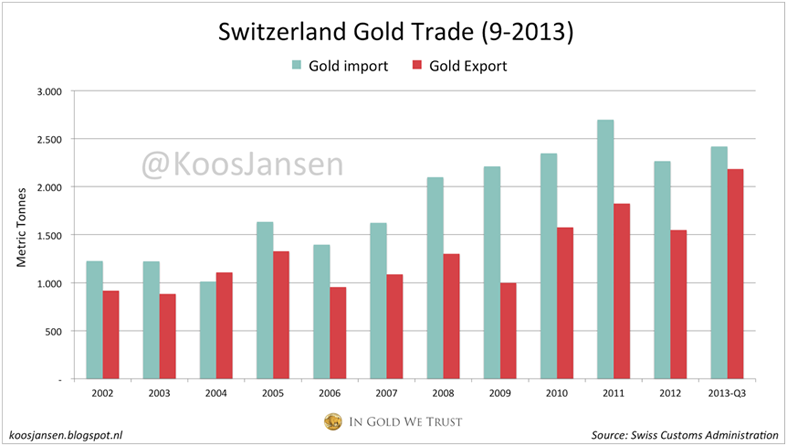

Koos Jansen's blog, "In Gold We Trust" explores the recent surge of bullion exports from Switzerland.

In it he notes that Switzerland holds four of the largest gold refineries on the planet - Metalor, Pamp, Argor-Heraeus and Valcambi. These refineries are estimated to be responsible for 70% of the world's refining nestled in the Swiss Alps, and therefore a major amount of the world's gold is distributed there.

If you look at 3Q, Switzerland has imported 808 tons of gold in 2013, and exported 680 tons. Year to date the country has imported 2,420 tons and exported 2,184 tons.

Courtesy of Koos Jansen’s - “In Gold We Trust”

Jansen notes that this is a new record for exports for the small country with a yearly estimate of 2,912 tons for exports. It is surmised that 1,100 tons of the gold bullion is set to flow East to China or Hong Kong.

In 2013 from January to August published figures list Hong Kong as having imported 598 tons from Switzerland. Jansen writes that although most of this is sent forward to Shanghai, however the Chinese are also importing directly from the Swiss.

This is verified from Shanghai Gold Exchange (SGE) physical deliveries and from Alex Stanzcyk, Chief Market Strategist at Anglo Far-East Bullion, who Jansen spoke with directly. Stanzcyk said, "China imports a lot that's not going through Hong Kong (or through the SGE!)".

In the interview Stanczyk explained how one of their partners had lunch recently with the head of the largest global operations company in security transport. He said there is a lot of gold that they're moving into China that's not going through exchanges. If the gold is for the government they don't have to declare where it's going. They don't have to declare where it's going in, or where it's heading. If you look at the way the Chinese do things, why would they tell?

The People’s Republic Bank of China (The Chinese Central Bank), tend to shy away from routine reporting of their outright gold purchases to the IMF. A sensible strategy given their implied policy of reducing dollar reserve risk.

GoldCore’s 10th Anniversary Gold Sovereign & Storage Offer

Click For Details: Gold Sovereigns

@ 5% Premium Over Spot (normally 8.5%-15% premium) & 1st Year's Storage @ Half Price Offer Closes October 25th

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.