The claim that the gold prices are manipulated is one of the most popular notions within the gold investing community. Probably, no other market (except the silver market) holds such a belief so strongly. The core argument goes as follows: an increase in price of gold signals inflation and the decline in the value of fiat currencies, especially the U.S. dollar, which undermines confidence in the contemporary monetary system. Thus, governments, central banks and their collaborators from the financial system are heavily interested in suppressing the price of gold.

Three insights support this theory: one theoretical and two empirical. First, the Austrian theory of money and business cycle says that gold was chosen as money by the free market and a monetary system based on fiat money is inherently unstable. Therefore, the price of gold would be higher without government interventions. Second, we know that the price of gold was fixed for decades by governments or suppressed under the London Gold Pool. Third, a few financial institutions (like Barclays) have already been fined for influencing or manipulating gold prices.

However, academic research conducted recently by Dirk Bauer did not find any clear evidence of gold price suppression. So is gold manipulated or not? Let’s investigate this issue in detail, starting with the above arguments.

First, we agree that gold used to be a free-market money for thousands of years and it would probably re-emerge again without the government meddling in the monetary system. We also agree that the current financial system is inflationary and eventually doomed to collapse (as the Bretton Woods was). However, nobody knows when the current monetary system will crash – it may actually take decades or centuries (like the collapse of Roman denarius) and there is no guarantee that gold would replace the U.S. dollar as the major currency in the new monetary system (some are looking at bitcoin and similar products for this purpose). Therefore, the price of gold is lower than in a monetary system based on gold as money, but it does not imply that it is manipulated. As the yellow metal no longer serves as genuine money, its value is simply lower.

Second, yes, the price of gold was fixed under the gold standard, but it was not manipulated. Gold was simply money, while the U.S. dollar was defined as a specific unit of gold weight, which naturally created a “fix”. It is also true that the governments tried to suppress the price of gold by creating the cartel of eight central banks pooling the gold reserves in the London Gold Pool. However, it was under the Bretton Woods system and gold was still used (at least partially) as money. The central banks and governments tried to regulate the price of gold because they wanted to assure the convertibility of the greenback into gold. But today, the U.S. dollar is no longer convertible into gold, so there is no need to control the gold price. For the Bretton Woods system to remain effective, the free market price of gold would have to be maintained near the $35 official foreign exchange price, since when it was higher, it was tempting for other countries to buy gold at the official price and sell it in the London gold market, which exacerbates the drain on the U.S. gold reserves.

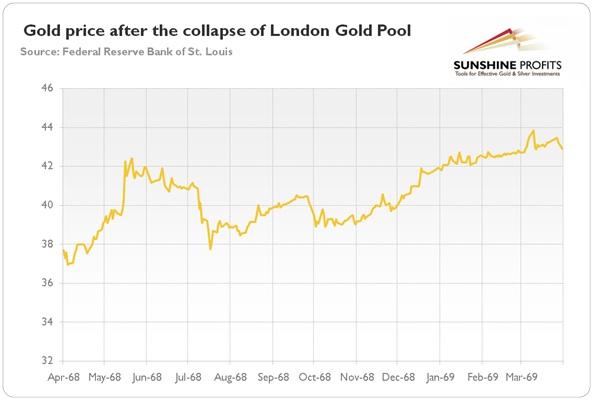

Actually, the history of the London Gold Pool shows that it is extremely difficult to systematically manipulate the price of gold. The market prices often diverged from $35 and the whole cartel collapsed after just a few years, bearing earlier huge costs to suppress the price of gold. Thus, even a group of the world’ eight most powerful central banks could not overcome market forces and merely stabilize the price of gold (but today, with a much larger and more liquid market the price of gold is believed by some investors to be systematically lowered).As one can see in the chart below, when the London Gold Pool ended, the price of gold rose.

Third, the case of Barclays (or other financial institutions) fined for influencing the setting the gold prices does not prove a systematic manipulation in the gold market. Why? Barclays was fined for failures in internal controls that enabled former trader Daniel James Plunkett to manipulate the gold price to avoid paying $3.9 million to a customer under an option contract. Therefore, what this case proves is that traders try to influence the markets to benefit their book. Nobody denies that this sort of price manipulation exists in financial markets; however, it is not the same as a global conspiracy systematically manipulating gold prices downward. In fact, traders try to influence the price of the underlying assets, including gold, around expiration dates both ways, depending on their position. Moreover, as James A. Kostohryz pointed out, they can manipulate the price only for a specific date, as later they have to unwind the positions that they initiated.

We have not discussed all arguments for and against the stance that the gold market is fundamentally rigged in this part, but neither theoretical considerations, nor historical examples analyzed so far prove that gold prices are systematically repressed by manipulation. There may be some minor and short-lived aberrations or direct manipulations, but gold market is simply too large and liquid to be systematically directed. Therefore, gold investors should base their decision on both technical and fundamental analysis of supply and demand, not the notion of manipulation. We do not deny that there are attempts to influence the price of gold, but they should not have systematic or lasting effects in the gold market.

If you enjoyed the above analysis and would you like to find out whether the gold market is manipulated, we invite you to read the February Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.