We sent out 2 Gold & Silver Trading Alerts yesterday and the situation at this time remains just as we described it in the second of them. Consequently, we will mostly quote it, illustrate the phenomena mentioned, and add more comments when necessary. Let’s start with gold

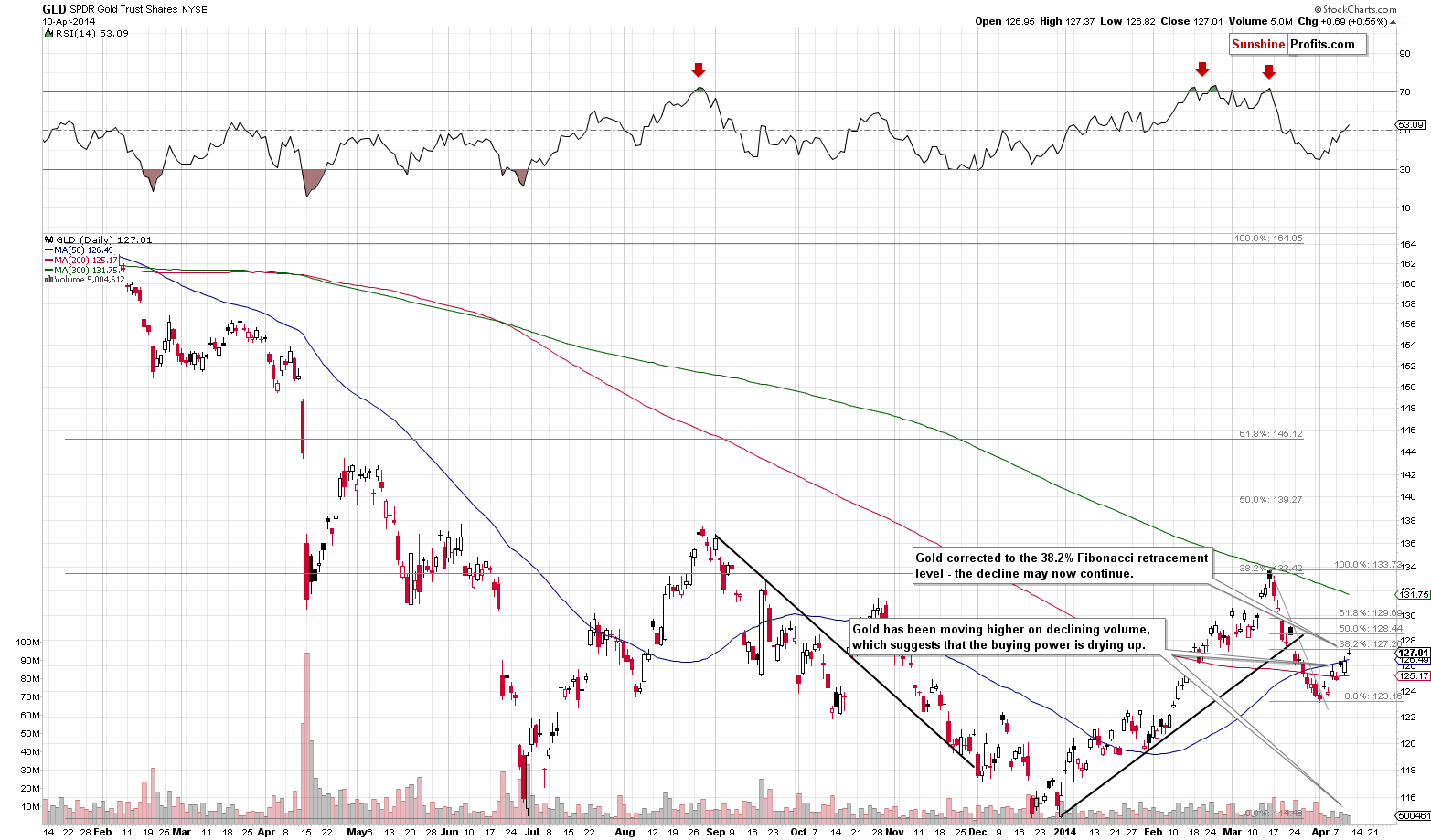

- About gold: "Please note that this upward correction is relatively small – it hasn’t even wiped out 38.2% of the March decline. Perhaps this is the level that will be reached before the next local top is in – we will watch out for signals confirming this theory."

This level was reached today.

Today, we can add that the GLD’s rally was accompanied by volume that was slightly lower than on the previous day, when the rally was much smaller. The above is another bearish sign.

- About silver: "Silver continues to underperform and miners are indeed moving higher, but they are doing so on rather low volume. It does seem that the current upswing is a corrective move, not a true rally. If silver finally rallies strongly relative to the rest of the precious metals sector it will quite likely not be a bullish sign, but a day when the entire sector tops (or very close to it). That’s not a clear prediction, just an early heads-up – we don’t think that jumping on the silver bandwagon as soon as it seems to be gaining speed is a good idea at this market juncture. There will be a time when silver rallies strongly and the rally will be sustainable, but it doesn’t seem we are at this point just yet."

Silver rallied by more than 1.5%, while gold moved higher by less than 1% and miners didn't rally. Silver moved above the previous April highs - we are seeing the very short-term outperformance.

Silver finally ended the session lower than it had been when we sent out yesterday’s alert, but still, it moved higher (percentagewise) than gold and mining stocks, so the implications remained in place.

- About mining stocks: "The mining stocks are still moving higher and are still doing so on low volume. Miners are moving up more visibly than gold does, which is a slight indication that the move higher is not over yet, but at the same time the low volume suggests that the rally will not take place for much longer."

Today, miners are underperforming in a very visible way. They might catch up later today, but for now, we get a clear bearish indication for the short term.

Miners didn’t catch up – they declined even more, almost 2%. The volume that accompanied the decline was not huge, but was not very low either. The fact that miners have declined almost 2% while gold moved higher is much more important in our view.

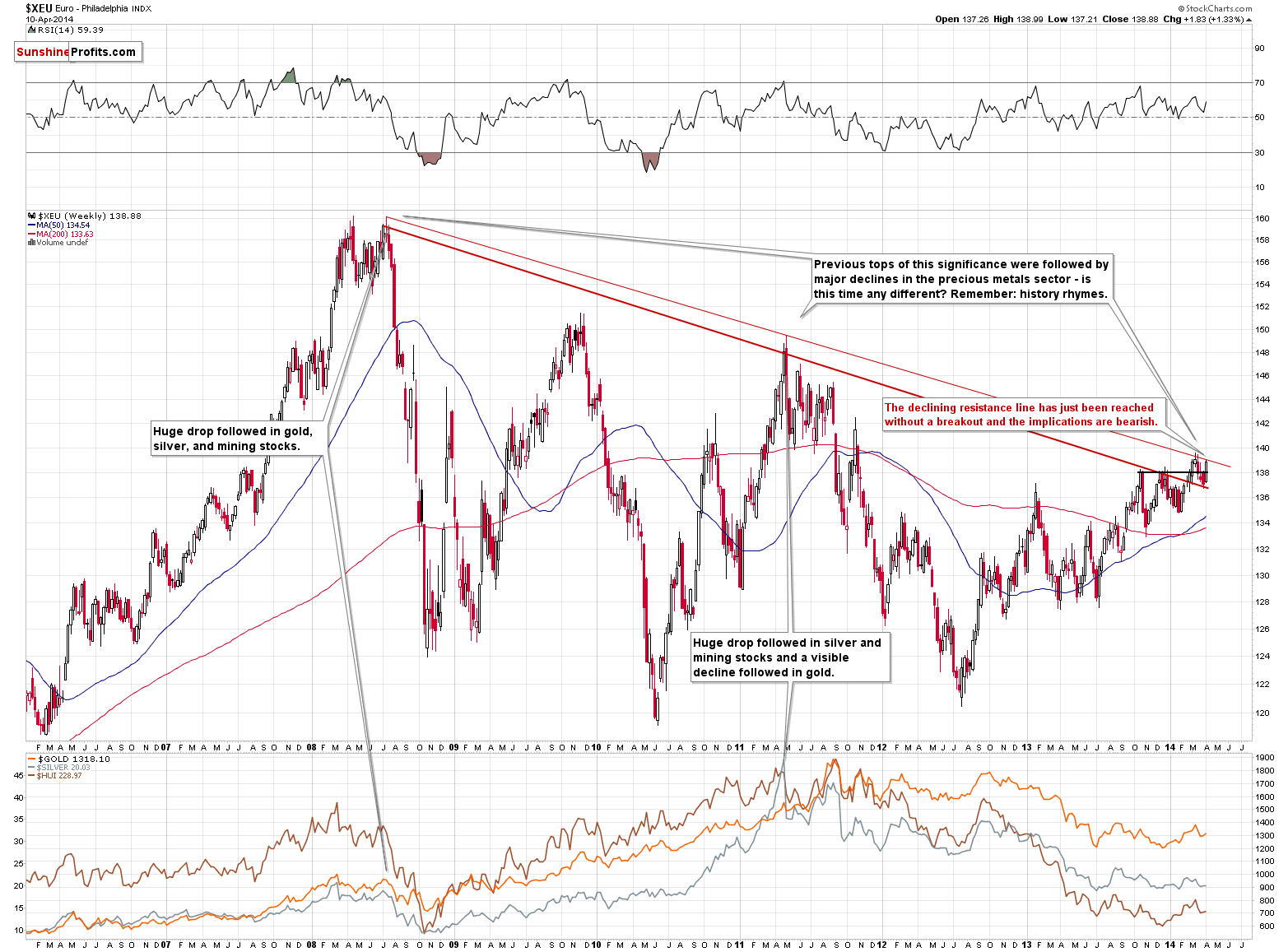

- About the Euro Index: "We will be looking for confirmations along the way, but at this time our best guess is that the Euro Index will rally to the 139 level or close to it (a move to the March high is not out of the question) and make gold move to one of the Fibonacci retracement levels – probably the first one, which is just about $10 higher than where gold closed on Wednesday."

The Euro Index moved to 138.99 today - practically reaching the above-mentioned 139 level.

The 138.99 level was not breached yesterday, and we saw only a small move above it in today’s pre-market trading (to 1.3906 in the EUR/USD exchange rate, after which we saw another slide back below 1.39). Consequently, the above-mentioned implications remain in place.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.