Oil sold off on Doha disappointment, but selloff could have been steeper

Rebalancing of the oil market is well under way, with US production falling

Strike hits Kuwait production, lends some support to beleagured oil prices

Prices could drop back to low $30s if Saudi Arabia fights Iran for market share

Net long position reached new record last week, contango collapsed

Watch $37.50/b on WTI and $40 Brent; break below could mean deeper downside

The oil markets reacted negatively today to the failed Doha meeting at the weekend. Some may ask why the selloff wasn’t any more severe considering that Opec once again showed a complete failure of leadership.

The rebalancing in the oil market is well under way, though it’s not Opec and Russia doing it, but rather North America where the production will continue to fall at such low oil prices. Some "support” came today from an oil workers' strike over pay in Kuwait, which has seen production fall 60% from its daily rate of 3 million barrels.

Crude oil, in my opinion, will remain range-bound for the next few months before rising as we move into the autumn. During this time, I see limited downside risk to oil beyond $35/barrel.

What could upset this equation is if Saudi Arabia turns its oil weapon on Iran. At the weekend the Saudis made threats which could indicate that they may choose to enter a market-share battle with Iran. If they decide to raise production to maintain market share, we could see the price drop back to the low $30s.

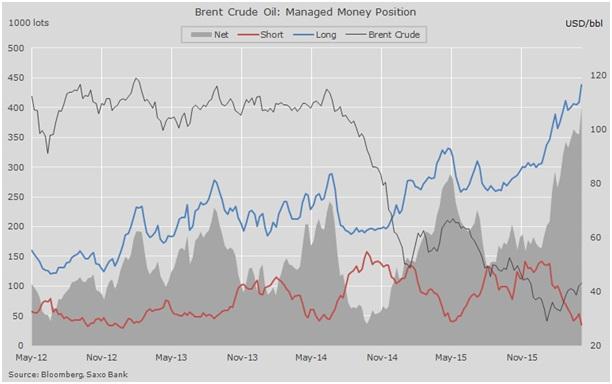

Hedge funds positioning, meanwhile, has turned even more extreme than we have seen already. Data published this afternoon on Brent crude oil speaks volumes.

The net-long position last Tuesday reached a new record above 400,000 barrels. The continued increase in bullish bets has tied in with the contango collapse in recent weeks, which has been taken as a sign of reduced oversupply. Most of this change has been at the very front of the oil curve and reflects lower supply in June and July due to maintenance in the North Sea. A lower contango reduces the pain of rolling long positions, hence the increased demand for Brent relative to WTI.

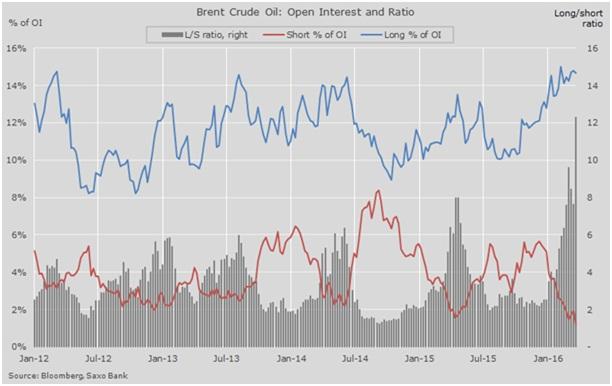

Another measure is the number of longs per short contract. As shown below, this ratio blew out to 12.3 last week. A reading this high is well and truly extreme, and it shows that the market is running out short positions to cushion a potential drop in the market.

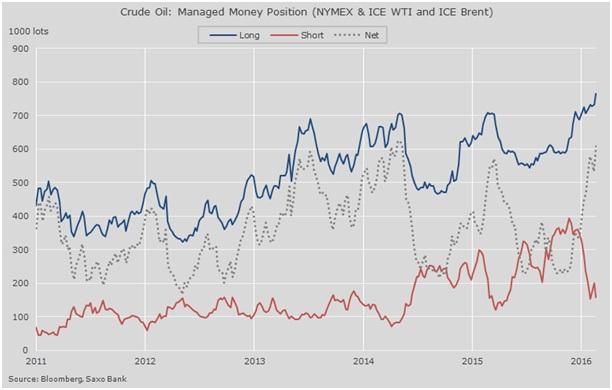

A combined look at Brent and WTI show a near record net long of 608,000 contracts (608 million barrels), while the gross long has reached 766,000 contracts.

Oil is holding up relatively well today, but keep an eye on $37.50/b for WTI and $40/b for Brent crude. A break below this trendline and psychological level respectively could signal a deeper downside risk.

- The author(s) and Saxo Capital Markets HK Limited are not responsible for and not liable to any loss arising from any investment based on any recommendation, forecast or any other information contained herein. The contents of this publication should not be construed as an express or implied promise, guarantee or implication by Saxo Capital Markets that clients will profit from the strategies herein or that losses in connection therewith can or will be limited. Trades in accordance with the recommendations in an analysis, especially in leveraged investments such as foreign exchange trading and investment in derivatives, can be very speculative and may result in losses as well as profits, in particular if the conditions mentioned in the analysis do not occur as anticipated. Investors should carefully consider their financial situation and consult their professional advisors as to the suitability of their situation prior to making any investments.

- Risk warning: Leveraged investments in foreign exchange or derivatives carry a high degree of risk and may result in significant gains or losses. You should carefully consider your financial situation and consult your independent financial advisors as to the suitability of your situation prior to making any investments.

Saxo Capital Markets HK Limited holds a Type 1 Regulated Activity (Dealing in securities); Type 2 Regulated Activity (Dealing in Futures Contract) and Type 3 Regulated Activity (Leveraged foreign exchange trading) licenses (CE No. AVD061) issued by the Securities and Futures Commission of Hong Kong.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.