Key developments in FX today:

-

The USD was sideways versus the euro and slightly higher against the JPY by later in the day after USDJPY tested the lows for the cycle overnight. A strong rally in commodities and risk appetite generally saw the yen's fortunes waning ahead of the US trading session today. Elsewhere, the strongest currencies were commodity linked currencies and sterling, which enjoyed the upbeat mood on the day.

-

Next, we look for whether the very tight EURUSD range is broken to the upside in days to come (or today), or if the risky currency vs. G3 (USD, EUR, and JPY) theme of today's session continues this week (i.e., sideways action among the G3, with risky currencies continuing to press higher. The key US data releases this week are the March Retail Sales data on Wednesday and the March CPI data on Thursday. The USD bulls look hard pressed in the USD/commodity dollar pairs today.

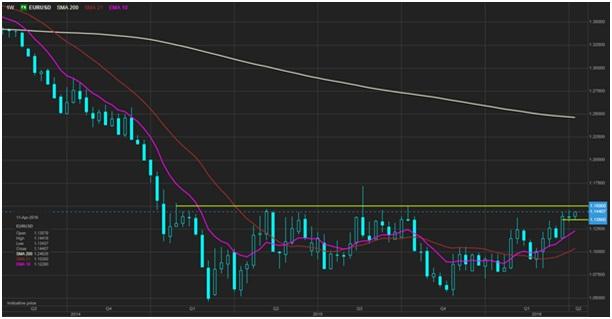

EURUSD - weekly

EURUSD making a bid late today for the upside as 1.1450 is the last local resistance ahead of the obviously important psychological level at 1.1500. The entire zone between 1.1500 and 1.2000 is a effectively a "gap" as we've only traded within that range for a bit more than two weeks over the last

USDCAD

Rather typical of the commodity currencies today and after a strong rally in the oil price, USDCAD is pressing lower and is not far from the recent lows and critical chart area just below 1.2850. though it appears we may have a descending channel on our hands more than a notable break level.

XAGUSD - weekly

Silver has blasted sharply higher here - handily taking out the local resistance and setting its sights on the critical structural level higher: what appears to be an upside down head and shoulders formation with its neckline in the 16.00/25 zone. The textbook target on a break higher would be 100% of the height of the original formation, which puts us right back at the next major resistance level near 18.50.

- The author(s) and Saxo Capital Markets HK Limited are not responsible for and not liable to any loss arising from any investment based on any recommendation, forecast or any other information contained herein. The contents of this publication should not be construed as an express or implied promise, guarantee or implication by Saxo Capital Markets that clients will profit from the strategies herein or that losses in connection therewith can or will be limited. Trades in accordance with the recommendations in an analysis, especially in leveraged investments such as foreign exchange trading and investment in derivatives, can be very speculative and may result in losses as well as profits, in particular if the conditions mentioned in the analysis do not occur as anticipated. Investors should carefully consider their financial situation and consult their professional advisors as to the suitability of their situation prior to making any investments.

- Risk warning: Leveraged investments in foreign exchange or derivatives carry a high degree of risk and may result in significant gains or losses. You should carefully consider your financial situation and consult your independent financial advisors as to the suitability of your situation prior to making any investments.

Saxo Capital Markets HK Limited holds a Type 1 Regulated Activity (Dealing in securities); Type 2 Regulated Activity (Dealing in Futures Contract) and Type 3 Regulated Activity (Leveraged foreign exchange trading) licenses (CE No. AVD061) issued by the Securities and Futures Commission of Hong Kong.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.