Price of oil the key factor driving global sentiment this year

Crude prices, equity indices remain highly correlated

Further fall in oil prices could see USDRUB vols spike

More in the pipeline: Crude oil prices have been the key driver of global sentiment in 2016, and the situation does not appear likely to let up anytime soon.

By Ben Ridgeway

The price of oil has arguably been driving markets more forcefully than any other factor so far in 2016. WTI crude futures hit a low of $28.35/barrel on January 20 but showed a recovery on January 22 and into the beginning of this trading week.

The rise came as Khalid Al-Falih, head of Saudi Aramco, spoke at The World Economic Forum in Davos. He mentioned that the company would not cut production and that a recovery in prices this year was "inevitable". In London on January 25, Opec secretary general Abdalla Salem El-Badri expressed concern over the low oil price and mentioned that both members and non-members of the group need to work to ensure prices move higher. The oil price has had a remarkably direct correlation with equity indices in 2016. WTI crude oil futures suffered their biggest decline over a session so far this year when the price dropped 5.35% on January 6. On that day and the next, the Dow Jones Industrial Average index lost 644 points. Moreover, slowing growth in China has led the Bloomberg Commodity index to trade at an historic low, and this has caused trouble in Asian equities and stocks worldwide too.

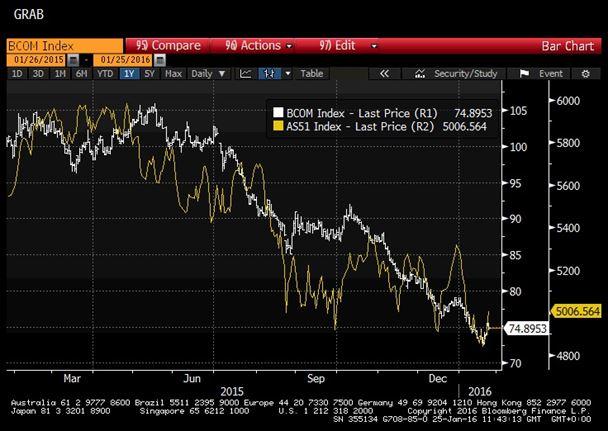

Notice on the graph below the correlation below between the price of the aforementioned commodity index and the Australian stock exchange.

It goes without saying that global markets are inextricably linked, and the decline in demand for raw materials has hurt currencies reliant on such exports (the Aussie and Kiwi dollars to name just two).

The oil price move has impacted currencies with economies reliant upon global appetite for "black gold". In the second half of 2014, oil prices almost halved from $100/b. Russia is the second largest oil producer in the world after Saudi Arabia, and USDRUB moved dramatically towards the 79.0 figure at this time, particularly after the central bank in Russia raised the benchmark interest rate for the nation from 10.5% to 17.0 in response.

The spot pair at nearly 80.0 now in a nervous market, but volatility hasn’t moved in the same fashion. Below is a graph of spot USDRUB over the last two years as well as the volatility of the one-month straddle for that pair. Ultimately, the options are sensitive not just to price but to volatility too. A base interest rate rise of 6.5% would definitely cause this, and the spot move can be seen to be more pronounced than those of the last six to nine months.

Traders may still view USDRUB options as cheap, however, where volatilities and thus premiums have remained relatively stagnant over this time. Sentiment can be a driving factor, and should the oil price head towards $10/b, panic may lead volatilities in this currency pair to levels seen two years ago.

An extraordinary meeting was held in Norway yesterday between the prime minister, the finance minister and the Norges Bank governor. The national reliance on demand for oil and the market price thereof was the only topic on the agenda.

Norway is the largest oil exporter in Europe and one of the most prominent worldwide. The central bank is ready to lower the base interest rate further from the current level of 0.75% to compensate for the difficulties. The weaker NOK trades currently at around the 8.75 mark versus the greenback.

Initially, it may come as a surprise to notice on the graph below that the one month 25-delta risk reversal has moved significantly lower over the past year...

Taking a look at current premiums for options on oil, however, the pricing of the risk-reversal makes some sense. Indeed, USDNOK spot has moved higher, but there are fewer buyers of USD calls than there were a year ago. Furthermore, the price of a call option on the WTI crude oil future is far higher than that of a put.

There is downside risk to oil, of course, but the options market still sees more value in the $40 and $50 strikes than those at $20 and $10. Hence, the possibility of a move lower in USDNOK is higher despite the price action of late, and thus the risk reversal above has moved towards par.

Lastly, in terms of USDSAR there have been increasing flows in the currency pair with buyers amongst the interbank market of interest rate and currency options. Volatility has recently risen from 0.5% to 3.25% in the one-month currency straddle on the rumour that the USD peg will become a thing of the past.

The same can be said for other currencies, including HKD and AED. The oil price has always been a key driver of financial markets and it appears to be more important than ever at the moment.

As tensions in the Middle East continue to a rise, particularly between Sunni Saudi Arabia and Shia Iran, the precise level that crude oil trades at could be a matter of dollars away from moving markets in one direction or the other.

- The author(s) and Saxo Capital Markets HK Limited are not responsible for and not liable to any loss arising from any investment based on any recommendation, forecast or any other information contained herein. The contents of this publication should not be construed as an express or implied promise, guarantee or implication by Saxo Capital Markets that clients will profit from the strategies herein or that losses in connection therewith can or will be limited. Trades in accordance with the recommendations in an analysis, especially in leveraged investments such as foreign exchange trading and investment in derivatives, can be very speculative and may result in losses as well as profits, in particular if the conditions mentioned in the analysis do not occur as anticipated. Investors should carefully consider their financial situation and consult their professional advisors as to the suitability of their situation prior to making any investments.

- Risk warning: Leveraged investments in foreign exchange or derivatives carry a high degree of risk and may result in significant gains or losses. You should carefully consider your financial situation and consult your independent financial advisors as to the suitability of your situation prior to making any investments.

Saxo Capital Markets HK Limited holds a Type 1 Regulated Activity (Dealing in securities); Type 2 Regulated Activity (Dealing in Futures Contract) and Type 3 Regulated Activity (Leveraged foreign exchange trading) licenses (CE No. AVD061) issued by the Securities and Futures Commission of Hong Kong.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.