Post-NFP USD bull trend weakens

GBPUSD could be primed for a move towards 1.46

Rate spreads suggest NZD remains overpriced

Key FX developments today

The spike in USD strength after Friday's nonfarm payrolls data generally failed to carry through into the Asian and early European sessions today, as EURUSD consolidated back toward 1.0800 briefly and USDCHF even nipped parity before bouncing again.

But the greenback found sellers around key levels, keeping the USD bulls tactically happy.

USDJPY found additional upside early on, even as the USD was consolidating elsewhere. The JPY weakness, however, faded later in the day as risk appetite came under pressure in the early New York equity trading session.

Interesting to see JPY responding to risk-off when at the same time we have interest rates poking higher.

Looking ahead

We held key tactical levels in most USD pairs, so now it is about seeing follow through higher for the greenback from here to new highs for the cycle (with discomfort for bears if today's USD supports are taken out).

Charts: GBPUSD

There were few technical developments on the day today, but we will highlight GBPUSD where we have key UK data (earnings and employment) on Wednesday, as sterling, has been trying to play the pro-cyclical Bank of England/Federal Reserve correlation game since the strong US data on Friday.

This is a bit surprising, given the dovish blast from BoE governor Mark Carney and company last week in what was likely an attempt to stave off excess sterling strength versus the euro.

After Wednesday, we'll see whether the scenario here in GBPUSD remains one of a choppy descending channel or an inverted head-and-shoulders scenario targeting 1.4600 eventually.

We prefer the latter scenario, though strong UK data could put a squeeze on fresh shorts.

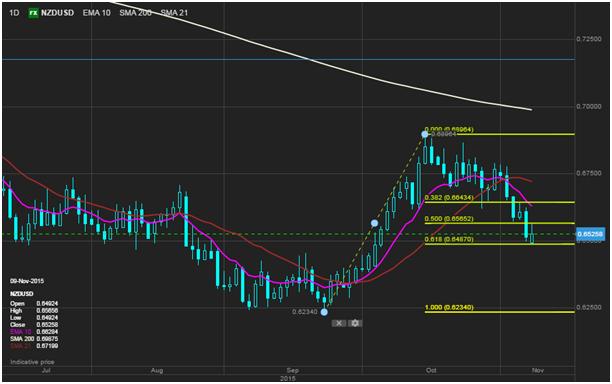

Charts: NZDUSD

The technical trigger here is a bit more clearcut than elsewhere, as AUDNZD action today has criss-crossed the 200-day moving average and NZDUSD has recently found support near the 61.8% Fibo retracement.

It feels like the technical interest in kiwi trades could be more significnat than elsewhere given these types of triggers for a view. Australian versus New Zealand rate spreads suggest that the kiwi is more mispriced (on the strong side, i.e., AUDNZD should theoretically trade higher and the NZ/US rate spread has touched new lows for the cycle. A break of the sub-0.6500 area supports here could quickly open up for a test of the cycle lows just below 0.6250.

The article above is solely the author’s personal opinion and shall not be deemed as promotion of and/or recommendation to invest any financial product. Investment involves risk, prices of financial product may fluctuate from time to time and may even worthless. Investor should carefully read and consider all relevant investment products’ offering document and risk facts before making any investment decision.

Risk warning: Leveraged investments in foreign exchange or derivatives carry a high degree of risk and may result in significant gains or losses. You should carefully consider your financial situation and consult your independent financial advisors as to the suitability of your situation prior to making any investments.

- The author(s) and Saxo Capital Markets HK Limited are not responsible for and not liable to any loss arising from any investment based on any recommendation, forecast or any other information contained herein. The contents of this publication should not be construed as an express or implied promise, guarantee or implication by Saxo Capital Markets that clients will profit from the strategies herein or that losses in connection therewith can or will be limited. Trades in accordance with the recommendations in an analysis, especially in leveraged investments such as foreign exchange trading and investment in derivatives, can be very speculative and may result in losses as well as profits, in particular if the conditions mentioned in the analysis do not occur as anticipated. Investors should carefully consider their financial situation and consult their professional advisors as to the suitability of their situation prior to making any investments.

- Risk warning: Leveraged investments in foreign exchange or derivatives carry a high degree of risk and may result in significant gains or losses. You should carefully consider your financial situation and consult your independent financial advisors as to the suitability of your situation prior to making any investments.

Saxo Capital Markets HK Limited holds a Type 1 Regulated Activity (Dealing in securities); Type 2 Regulated Activity (Dealing in Futures Contract) and Type 3 Regulated Activity (Leveraged foreign exchange trading) licenses (CE No. AVD061) issued by the Securities and Futures Commission of Hong Kong.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.