Yesterday’s Trading:

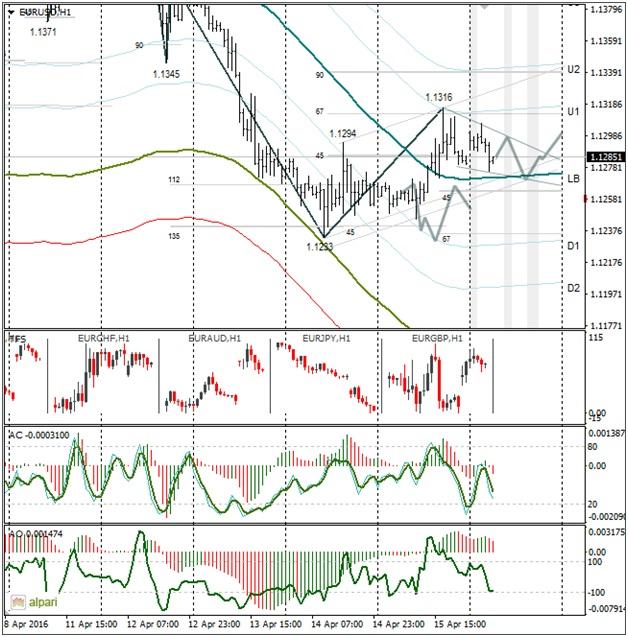

Economic data from the US on Friday was ambiguous, allowing the euro/dollar to rise to 1.1316. The New York business activity index exceeded expectations. The index for industrial production and the university of Michigan’s index were worse than expected.

The index for business activity from the federal reserve bank in New York was 9.6 for April (forecasted: 2.21, previous: 0.62).

The index for industrial production in the US for March was down 0.6% MoM against a forecasted 0.1% fall (previous: reassessed from -0.5% to -0.6%). The Michigan index for consumer confidence was 89.7 against an expected 92 and a previous 81.

Market Expectations:

Trading on Monday opened up for the dollar against commodity currencies. On Sunday in Doha negotiations regarding a freeze to oil output collapsed. The main reason for this was the lack of an Iranian representative present. The next OPEC meeting will take place in Vienna in June.

Brent fell 4.6% to $41.04. The euro/dollar opened up, but then followed the rest down and returned to 1.1275. The price is near the LB, indicating the balanced nature of the pair on the hourly and the readiness of the market to go astray. Since today is Monday – day of correctional movement – on my forecast I’ve gone for a sideways movement above the LB.

Day’s News (EET):

-

13:00, monthly Bundesbank report in Germany;

-

15:30, Canadian data on foreign securities transactions in February;

-

15:30, New York Fed’s William Dudley to speak;

-

17:00, NAHB April housing market index.

Technical Analysis:

Since the AO indicator is in the positive, I expect to see an update of the Asian minimum. If we make an upwards channel, then we see that the price should remain above 1.1267. Since today is Monday, there’s no point going deep into the technical analysis.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD regains 1.2350 ahead of UK PMIs

GBP/USD is recovering ground above 1.2350 in the European session, as the US Dollar comes under fresh selling pressure on improving risk sentiment. The further upside in the pair could be capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.