Yesterday’s Trading:

The euro/dollar has been in a sideways since April Fools’ Day. All of the daily candles are similar to dojis with long shades for these days. The mixed dynamic of the pair yesterday was caused by a rise in oil prices and because of what Fed representative Harker had to say.

Oil was up to $44.78 due to rumours that Russia and Saudi Arabia have reached a consensus as to freezing oil output. There was no confirmation of this from officials. Harker announced that the Fed could raise rates three times this year if inflation speeds up.

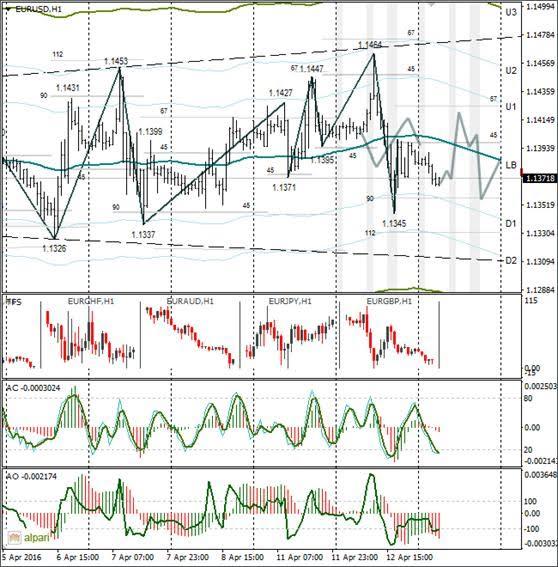

The euro/dollar closed at 1.1383 and was treading near the LB in the middle of a 1.1326-1.1464 range in Asia.

Market Expectations:

On Tuesday the API oil reserve report came out before the daily candle closed. US oil reserves were up 6.2 million against the previous week’s fall of -4.3 million. Brent dropped to $44.11 on this news. It was an insignificant fall in the quotes for the rise in reserves due to market participants’ attention being firmly focussed on the OPEC meeting in Doha. We could say that Brent in Europe is in any case set to test $45 and after which we would see the start of a correction.

The key event of the day is the Bank of Canada’s (BoC) press conference. The hourly indicators are down and aren’t contradicting euro purchases in the first half of the day. The euro is expected to close at around 1.1380.

Day’s News (EET):

12:00, Eurozone changes in industrial production for February;

15:30, US changes in retail trade and PMI for March;

17:00, BoC interest rate decision and monetary policy report;

17:30, US oil reserves from Ministry for Energy;

18:15, BoC press conference;

21:00, US Beige Book.

Technical Analysis:

The euro/dollar has been in a sideways trend with a 1.1394 average for 8 days. A break in the lower limit of the range at 1.1326 will open up the road to 1.1250 for the sellers. We need to prepare ourselves for a weakening of the euro. The 1.1396/1.14 levels will be Wednesday’s resistance. Expect some swings during the American session during the BoC press conference and when the US Ministry for Energy oil report is released.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 ahead of US data

EUR/USD stays in a consolidation phase slightly below 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.