Yesterday’s Trading:

The USD on Monday closed up against the EUR. The euro/dollar was down against Friday’s 1.1079 minimum. Trading volumes are still low on the market at participants lie in wait for central bank announcements.

Market Expectations:

A two-day FOMC meeting begins on Tuesday. No one expects the Fed to change their rates this time round. Market participant attention will be on Yellen’s speech which follows the meeting.

Important economic data which could have an effect on the currency pairs is nowhere to be seen. Due to this I expect to see the euro drop to 1.1055.

Day’s News (EET):

12:00, Eurozone employment level for Q4.

14:30, US retail sales changes and PMI for February.

16:00, US housing market index from NAHB for March and changes in business inventories.

22:00, purchases of American long-term assets by foreign investors in January.

Technical Analysis:

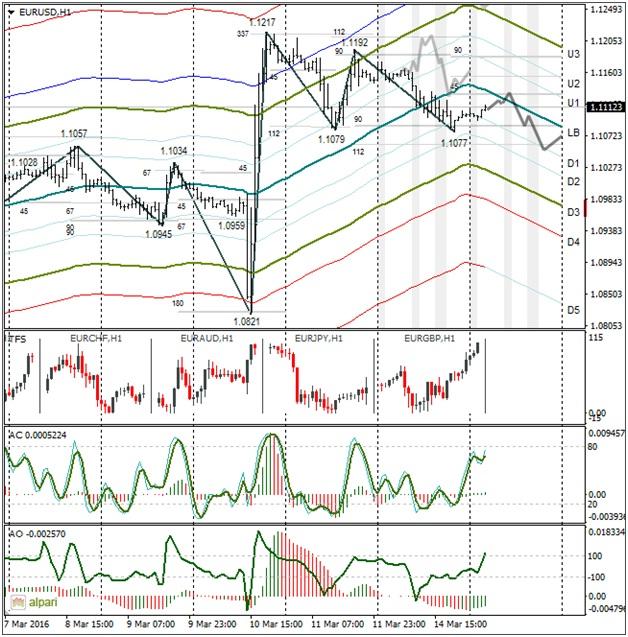

Intraday target maximum: 1.1130, minimum: 1.1055, close: 1.1075.

Intraday volatility for last 10 weeks: 103 points (4 figures).

The sellers on Monday managed to strengthen below the LB (1.11) This is a bearish signal for the market since a fall below 1.1065 will see the road to 1.10 open up for the sellers.

Whilst the price is above 38% of growth from 1.0821 to 1.1217, a euro strengthening could resume at any time. An important intra-day resistance is at 1.1150.

Keep an eye on the euro/pound cross rate. The euro in this cross is set to weaken. A fall of the cross due to a USD strengthening would see the euro/dollar fall to1.1020 on the European session without taking any pit stops.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.