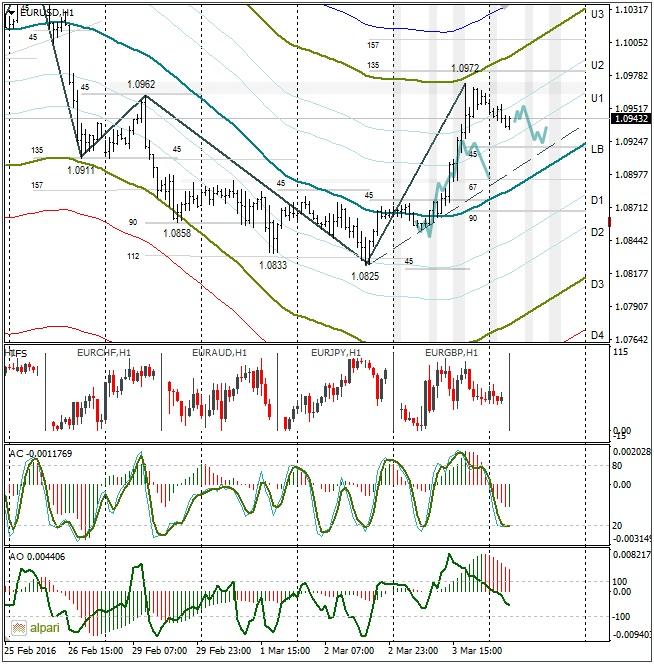

EURUSD 1H

Yesterday’s Trading:

The currency market on Thursday saw the closing of long positions before data on the US labour market came out. The euro/dollar rose from 1.0853 to 1.0972 (+120 points) This euro/dollar growth was expected since the dollar had strengthened significantly against the pound and Aussie dollar the three days prior.

Pressure on the rate came from US service sector data and initial unemployment benefit applications. Markit’s business activity index fell from 53.2 to 49.7; below the key marker of 50. ISM’s index fell from 53.5 to 53.4. The employment index fell from 52.1 to 49.7 which is key before the NFP.

Initial unemployment benefit applications in the US for the week stood at 278k (forecasted: 272k, previous: 272k).

Main news of the day (EET):

15:30, US NFP and changes in hourly wages for February. Simultaneously, the US and Canada will be releasing their Trading Balances for February;

17:00, Canadian Ivey PMI for February.

Market Expectations:

The key event for Friday is the NFP.

Technical Analysis:

Intraday target maximum: n/a, minimum: n/a, close: n/a;

Intraday volatility for last 10 weeks: 103 points (4 figures).

The euro/dollar rose to the U3 and stopped at the 130th Gann gradient. At 6:32 EET, the euro/dollar was trading at 1.0945. If we look at the daily, we see that the euro has reached a strong support zone: 1.0985-1.0990. If the NFP comes out above 220k, the euro will return to 1.0855. If it’s lower then we should expect a rise to 1.10550-1.1070. Any higher is anyone’s guess since the ECB is meeting on 10th March and it is expected that they will drop their deposit rate.

EURGBP 1H

My expectations for the cross came off in full. The euro/pound returned to the trend and balance line. I think that the price will remain under the trend until the NFP is out.

Daily

On Thursday the euro/dollar saw the closure of short positions and a restoral of the price to the LB. The indicators are continuing to show a rise in the pair but the NFP will have the last say.

Weekly

After yesterday’s strengthening of the euro, the weekly is seeing an inverted candle form on it. Let’s wait and see what the NFP and the close of the week brings.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.