Trading Yesterday:

The euro managed to sit at 1.0850 throughout the first half of Wednesday. After the February ADP data came out better than expected, the euro came under another wave of sales. Employment in the US private sector rose by 214,000 compared with a forecasted 190,000 and 193,000 in January. The report offered short term support to the dollar.

The driver weakening the euro was the euro/pound which fell by 120 points to 0.7690. The GDP/USD managed to avoid a fall and reach a maximum for the week due to the euro falling. The euro/pound fell by 120 points and the pound dollar rose by 170 points to 1.4092.

Main news of the day (EET):

16:45, US Markit service sector activity index for February;

17:00, US ISM business activity index in service sector and data on manufacturing orders for January.

Market Expectations:

The bearish set up on the euro continues, but I believe that we could see a strengthening of the euro against the dollar on Thursday as part of a correctional movement, following the pound/dollar and Australian/American dollar pairs. Trader attention will be on the publication of data regarding business activity in the service sector in different parts of Europe and the US.

Technical Analysis:

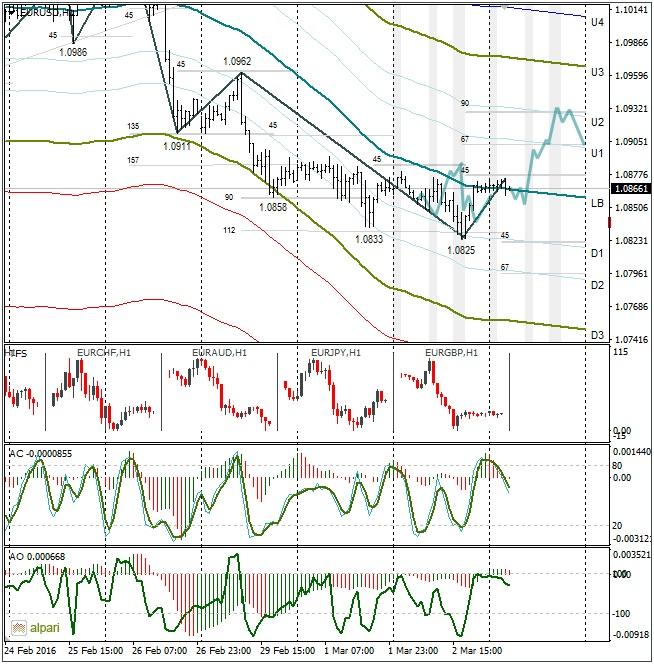

Intraday target maximum: 1.0930, minimum: 1.0845, close: 1.0900;

Intraday volatility for last 10 weeks: 103 points (4 figures).

This morning the euro was trading at around 1.0845. The price is at the balance line. This means that the market is balanced on the hourly and that the price is readying to stray from the LB by 0.6% or 1%.

The pound/dollar has risen by 270 points over the past three days and the euro has fallen by 60 points in this time. The time has come to reduce the gap between the pairs. As soon as the euro/pound starts to correct, the euro will quickly win back its losses due to the general weakening of the dollar. We will see it reach at least 1.0960.

EURGBP 1H

Yesterday I expected to see a rise in the cross to 0.7820. The euro strengthened against the pound to 0.7812 due to a weak UK construction sector PMI. In the second half of the day the sellers broke the support zone and brought the rate to 0.7690.

The trend line on the hourly runs through 0.7760. After a four-day fall, I expect an upward correction to the trend line. I am not looking at the news since the pound has been strengthening against the dollar (by 270 points) with weak UK stats. I believe that the euro could move by at least one figure without any news.

Daily

On Wednesday the euro/dollar shifted the weekly maximum to 1.0825. Two daily candles with long shades have formed. They are not so large, but indicate a slowing of the euro weakening. The stochastic has formed a euro buy signal. The CCI indicator is readying to cross the -100 line. I am sure that many traders have set Buy Stops on the euro at the maximum. I expect a rebound to 1.0960.

Weekly

I am waiting for the NFP on Friday and the candle for the week to close.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.