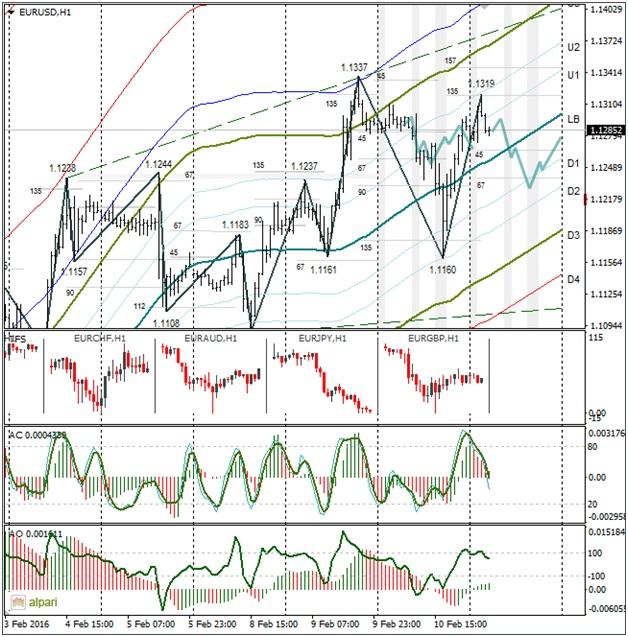

EURUSD 1H

Yesterday’s Trading:

Yesterday was a volatile one. The euro/dollar first dropped to 1.1237 due to growth of the European stock indices. Then at 15:30 EET the euro renewed its minimum in response to the publication of the text of Fed chief Yellen’s report.

The text of the report was published an hour and a half before she made her speech. I think that it was done quietly in order to lessen tensions on the financial markets. A difficult task lay ahead of Yellen: she needed be soft enough with her words so as not to scare off market participants, but at the same time use strong enough words to show that the US economy is not in need of additional support. In the text there was nothing about interest rates, so the dollar’s growth was conservative.

Following the speech, at 17:00 EET Yellen answered questions from congressmen. As she responded the dollar fell along with the stock indices. By the end of the day, the euro had won back all of its losses against the dollar and the stock indices were in the minus zone.

Yellen was asked about negative interest rates, to which she replied that the Fed will not have to consider dropping rates into the negative.

Main news of the day (EET):

15:30, Canadian December housing price index and US initial unemployment benefit applications;

17:00, Yellen to speak.

Market Expectations:

Yellen is set to speak again today, but it’s not worth expecting high volatility like we saw yesterday. We’ve already had answers from Yellen. The calendar is empty, so the movements across key pairs will be set by movements on the stock indices.

Technical Analysis:

Intraday target maximum: 1.1319 (current Asian), minimum: 1.1230, close: 1.1270;

Intraday volatility for last 10 weeks: 102 points (4 figures).

I expect to see a V-shaped model from the euro on Thursday. Just as yesterday, but with less amplitude. There are concerns that the market will head in a different direction since the euro/pound is able to head straight for 0.7813 after yesterday’s 0.7712 bounce. I reckon we’ll see a strengthening of the euro against the pound via a bounce to 0.7736. Here we again need to see how the European stock markets open. If it’s with a growth then the euro/dollar will fall. If they open down then it will rise. An ideal situation would be one where we have movement along 1.1260 before Friday.

EURGBP 1H

Due to the growth in the stock indices and the correction on other crosses, the euro/pound fell to 0.7712. The price has returned to the LB. I expect to see a fall to 0.7736 and then a rise to 0.7790. The rate could head up if the European stock markets open down and don’t go positive over the course of the day.

Daily

The euro/dollar fell to 1.1160 and closed at 1.1289 on Wednesday. After Yellen spoke, a long shade formed which indicates a continuation of euro growth. In order for the bull signal to be nullified, the sellers need to close the day below 1.1215.

Weekly

The target is still at 1.1366/70.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD: The first upside target is seen at the 1.0710–1.0715 region

The EUR/USD pair trades in positive territory for the fourth consecutive day near 1.0705 on Wednesday during the early European trading hours. The recovery of the major pair is bolstered by the downbeat US April PMI data, which weighs on the Greenback.

GBP/USD posts modest gains above 1.2450, BoE policymaker dampens hopes of summer rates cut

The GBP/USD pair recovers to 1.2450 during the early Wednesday. The downbeat US April PMI data and increasing appetite for the risk-linked space exert some selling pressure on the US Dollar.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.