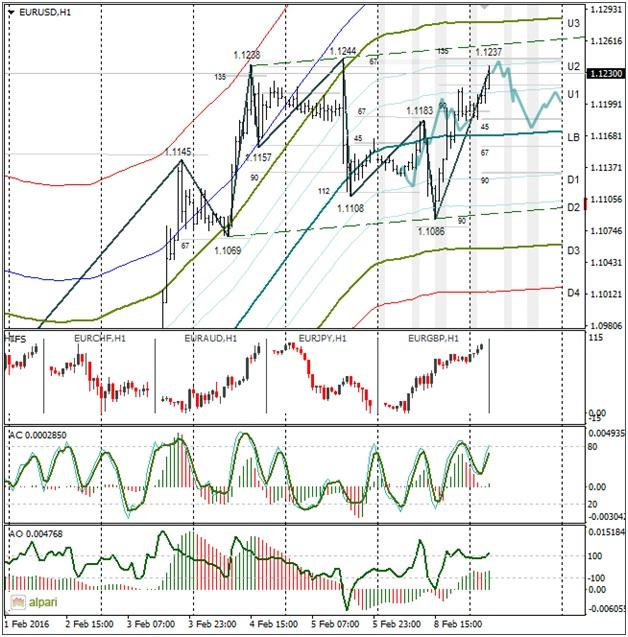

EURUSD 1H

Yesterday’s Trading:

A fall in the oil and stock indices has facilitated a fall in the dollar/yen to 114.20 and a rise of gold to $1,200 per troy ounce. The euro has strengthened against the dollar to 1.1215. The rate rose to 1.1237 in Asia.

The markets are closed for a week in China. Falling oil prices as more reserve reports are set to come out is putting pressure on the stock markets and bonds. The market is in a turbulent zone. The Nikkei 225 has fallen 5% this morning.

Main news of the day (EET):

09:00, German industrial production and balance of trade for December;

11:30, UK December balance of trade, BoE’s financial stability deputy governor, Jon Cunliffe, to speak.

Market Expectations:

The calendar is empty today. Trader attention is on Janet Yellen who is set to speak tomorrow and Thursday (17:00 EET). If she signals that the Fed is to wait and see whether to put up rates this year and not be neutral, the euro/dollar will shoot up. If the Fed chief is neutral, the market will sit in a sideways with sharp fluctuations up and down.

Technical Analysis:

Intraday target maximum: 1.1242, minimum: 1.1168, close: 1.1200;

Intraday volatility for last 10 weeks: 102 points (4 figures).

A complex wave structure has formed on the hourly period above 1.10. The resistance zone passes through 1.1238-1.1244. If we take a look at the channel, we may have a price blowout to 1.1258.

The euro/pound has bounced from the D3 and formed a pinbar. If the European indices don’t fall following the Nikkei 225, a downward correction will begin. The correction on the euro/pound will cause a downward movement on the euro/dollar. Volatility is high so the price could quickly head down to 1.1168 and then return back. So could the euro weaken against the dollar to 1.11? It could we do. Keep an eye on the stock indices and oil.

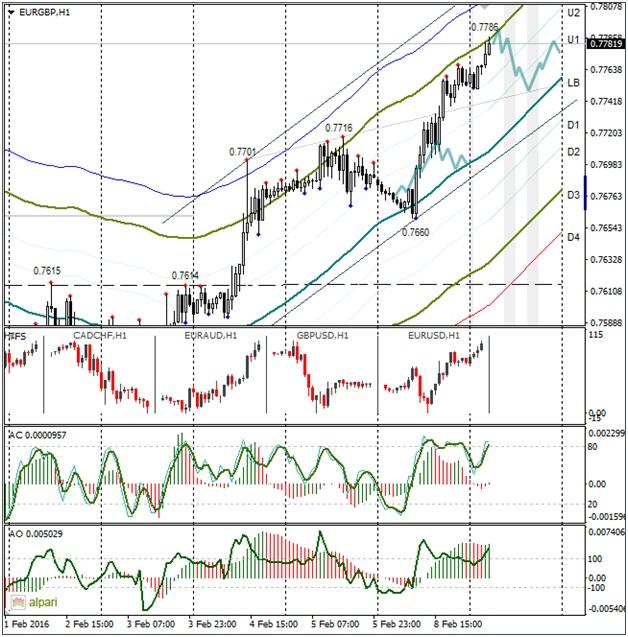

EURGBP 1H

A running from risks has caused a rise in demand for euro throughout the market. The euro/pound bounced from the LB and rose to the MA U3. I expect to see a recoil to the LB on Tuesday, just as we saw on 5th February.

Daily

A euro sell signal is still forming on the stochastic. The CCI indicator is nearing the +100 limit. If the stock indices fall hastens, the technical signals won’t work off and the euro/dollar will depart to 1.1370. If we go off the indicators used on the graph then it’s risky to sell euro.

Weekly

The euro/dollar will shift to 1.1366/70. The sellers can’t stop the euro from strengthening. The fall of the stock indices is supporting the buyers.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.