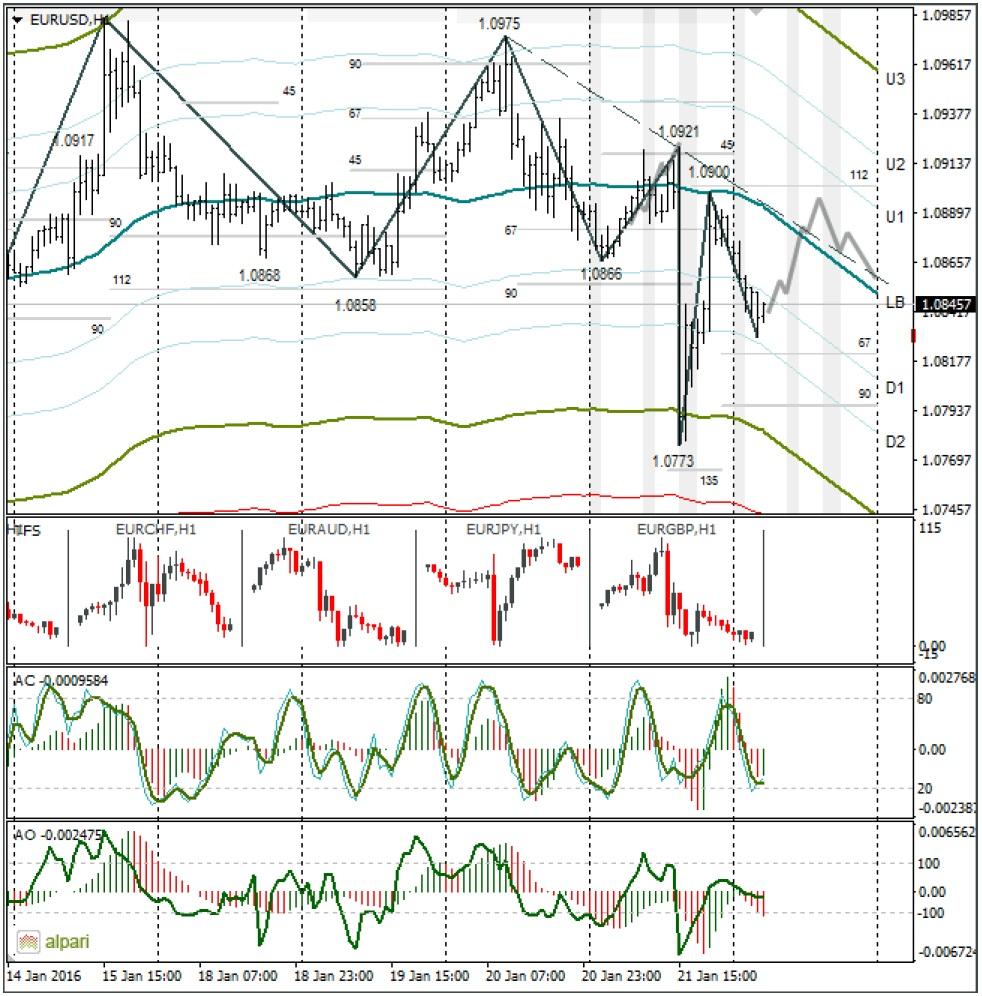

EURUSD 1H

Yesterday’s Trading:

The European trades on Thursday saw the euro/dollar head from 1.0866 to 1.0921 after the ECB had convened. The euro/dollar fell 148 points during Draghi’s speech to 1.0773.

The ECB left rates unchanged and Draghi announced that negative risks to the economy are on the rise. Due to falling oil prices, inflation will remain low for a long time and could drop further. The regulator is ready to introduce more measures to stimulate the economy. Some experts expect the ECB to drop interest rates for deposits in March.

The EUR/USD reacted negatively to the ECB announcement, but was able to restore to 1.0900 due to the dollar falling after the US Ministry for Energy published a report and a growth of oil quotes. The report was negative and oil went up. Why oil reacted to the report by rising in price is an absolute mystery to me. The informational agencies write that the reason was Venezuela calling on OPEC member states to hold an unplanned meeting to discuss oil prices. The Venezuelan oil minister has asked Ecuador, Algeria and Russia to help organise the meeting.

Main news of the day (EET):

10:30, German business activity in the manufacturing sector and service sector for January;

11:00, Eurozone business activity index manufacturing sector and service sector for January;

11:30, UK retail sales;

15:30, Canadian retail sales and CPI;

16:45, US business activity index manufacturing sector;

17:00, US December retail sales in the secondary housing market.

Market Expectations:

Almost all of the Asian stock indices are trading up, but the Chinese ones are down slightly. The euro/dollar is down. Trader attention on Friday will be on the publication of preliminary values for business activity in different regions. In the US, traders will be watching and waiting for the publication of the big business’ financial reporting in the country. For Friday I have the euro rising to 1.0895/1.0900.

Technical Analysis:

Intraday target maximum: 1.0900, minimum: 1.0829, close: 1.0855;

Intraday volatility for last 10 weeks: 100 points (4 figures).

Draghi has weakened the euro bulls but they are still strong due to the fall of the stock indices. If the euro falls below 1.0775, we could once again be aiming for 1.0650. I expect to see the euro strengthen on Friday since the hourly indicators for the euro/dollar and euro/pound are indicating growth.

EURGBP 1H

The euro/pound fell to the D3 during Draghi’s speech. The AO indicator is turning downside up. A euro buy signal has formed on the stochastic. If I am right, the euro/pound will return to the LB, thereby strengthening the euro’s position against the dollar.

Daily

Wednesday’s pinbar was worked off during Draghi’s press conference. The price bounced from the trend line. The bear mood remains, but keep an eye on the stock indices. Their fall will return the market to the buyers.

Weekly

The euro dollar has been trading in a sideways trend for six weeks. The buyers’ and sellers’ strength is equal. If we take the indicators and Draghi’s words into account, the sellers should have the advantage.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.