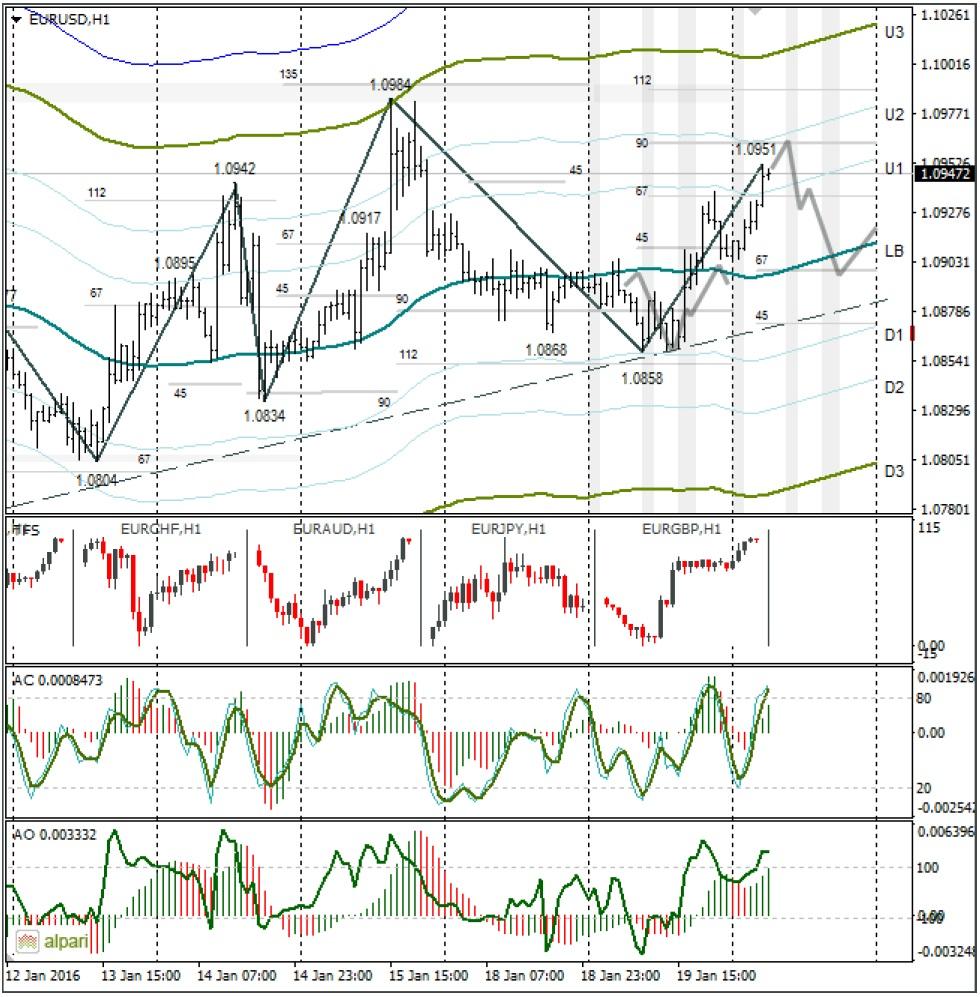

EURUSD 1H

Yesterday’s Trading:

Tuesday’s trading in the States closed with the euro/dollar at 1.0858. The euro dropped to this level due to stock indices and oil prices rising.

The euro strengthened during the American session because of oil and a sharp Uturn for the euro/pound after the Bank of England’s governor Carney gave a speech. He noted that the UK economy is weak and that now is not the time to raise interest rates. The pound crumbled against the dollar with his words by a total of 150 points. The euro/dollar had risen to 1.0938 by the end of the day.

Main news of the day (EET):

09:00, German December PMI;

11:30, UK labour market data: average wages for November, changes in unemployment benefit applications for December, November unemployment level;

15:30, Canadian wholesale and manufacturing sales for November

15:30, US construction permits and CPI;

17:00 BoC interest rate;

18:15, BoC press conference.

Market Expectations:

The euro/dollar is up in Asia due to a fall in Asian stock indices and oil prices. At 06:40 EET, EUR/USD was going for 1.0948. The Shanghai Composite was down 1.37%, the Hang Seng was down 3.77% and Brent stood at $28.11.

The euro updated its maximum against the dollar and pound, but we can’t really say that it will rise higher. Keep watch of the European stock indices and the euro/pound. The cross is in the sell zone. Don’t forget that the ECB is convening on Thursday, along with Draghi holding a press conference. Many market participants want to close long positions before the press conference since if there’s any word on further easing of monetary policy, stops will be set off. If the indices and oil rise in Europe, the euro/dollar will return to 1.0900.

Technical Analysis:

Intraday target maximum: 1.0962, minimum: 1.0899, close: 1.0920;

Intraday volatility for last 10 weeks: 100 points (4 figures).

The euro/dollar is trading at around 1.0948. I’m waiting for a test of the 90th degree when trades open in Europe and a turnaround downwards. I’m not sure whether the European indices will follow the Asian indices by falling. In any case, there will be a reaction. As the ECB meeting and Draghi’s press conference approaches, I expect to see the euro return from 1.0960 to the LB or 67th degree at 1.0899.

EURGBP 1H

The euro/pound cross is sharply up after Mark Carney spoke and a fall in oil prices. The euro is up against the pound due to a fall in the Asian indices. The price is out of the channel and the indicators are saying sell euro. On Wednesday I’m sticking with a fall in the cross to the LB. Be careful with euro purchases, even if European indices fall. You may head into the positive, but the risks of catching a stop are high.

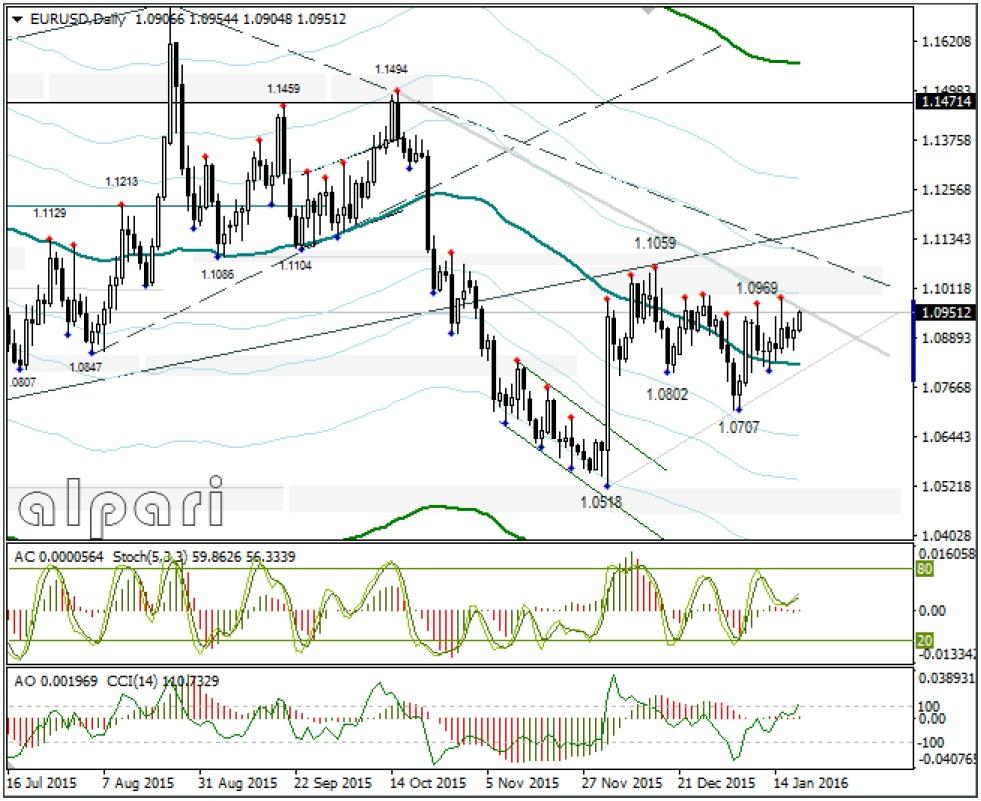

Daily

The euro bulls are trying to break through the trend line. Their success will depend on stock indices movements.

Weekly

The euro is trying to return to 1.1059.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.