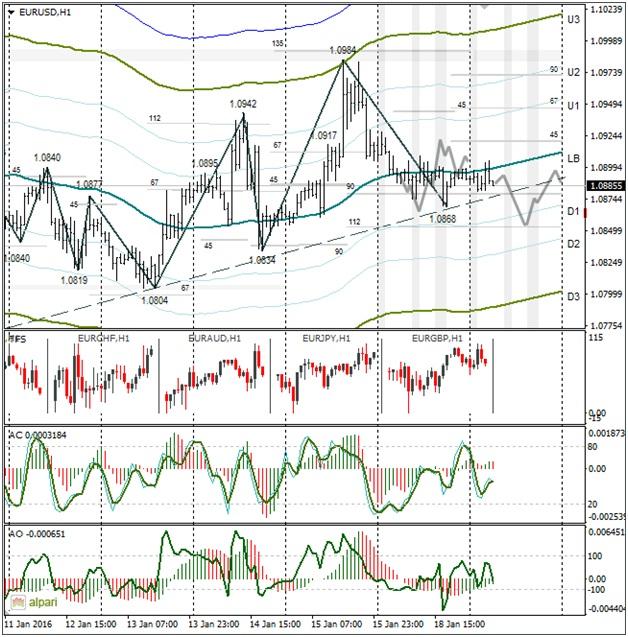

EURUSD 1H

Yesterday’s Trading:

On Monday the euro/dollar spent the day below 1.0900 due to Martin Luther King day in the US. The stock market situation stabilised. Market participants weren’t active as the release of Chinese stats approached.

Main news of the day (EET):

09:00, German December CPI;

11:00, Eurozone November balance of payments changes;

11:30, UK retail sales, PMI and CPI for December;

12:00, Eurozone business sentiment for January from ZEW and November CPI. German ZEW business sentiment;

14:00, BoE governor Carney to speak;

17:00, US housing market index from NAHB for January.

Market Expectations:

China published some data on GDP, industrial manufacturing volume and retail sales. Chinese GDP in 2015 slowed to 6.9% YoY against 7.3% in 2014. The data was as forecasted.

Industrial manufacturing volumes and retail sales were 5.9% and 11.1% against a forecasted 6.0% and 11.3%. The market hardly flinched on news of the data. This just confirms that market participants are having doubts about the dependability and credibility of the statistical data. The stock markets in this case are a better indicator for China. By 06:47 EET they were all up by 1.5% on average.

Trader attention on Tuesday will be on German and UK economic data. A V-shaped pattern with a 1.0854 minimum at 112 degrees is what I have for my forecast.

Technical Analysis:

Intraday target maximum: 1.0904 (current Asian), minimum: 1.0852, close: 1.0887;

Intraday volatility for last 10 weeks: 100 points (4 figures).

The euro/dollar is trading at around 1.0885. The price is near the trend line. Since the Asian stock indices are in the green zone and oil is in the red, in my forecast I’ve gone for a fall of the euro to 1.0854 with a subsequent rebound to 1.0887. I’ve gone for a fall due to the euro/pound cross.

EURGBP 1H

The stock market situation has stabilised. I expect the euro/dollar to fall before the ECB convenes. Due to this, I reckon the euro will be under pressure during the first half of today. According to the pattern, something should similar to yesterday should happen.

Daily

The situation isn’t clear on the time frame.

Weekly

The stochastic indicator and the AC are facing down and the CCI is facing up. There are risks we could see a return to 1.0820.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.