Hourly

Yesterday’s Trading:

The dollar index closed Monday practically unchanged to that of Friday. What the Fed members had to say didn’t have much effect on movements across key pairs. Trading volume remained low since US and Canadian markets were closed due to it being Columbus day and Thanksgiving.

The euro/dollar was trading around 1.1369 and dropped to the LB at 1.1343 in Asia.

Main news of the day:

At 11:30 EET, German inflation figures for September will be out;

At 11:30 EET the UK CPI, RPI and PMI for September will be out;

At 12:00 EET, Germany’s ZEW index for business mood in October will be out.

Market Expectations:

Today’s intraday attention for traders will be focussed on the publication of inflation figures for Germany and the UK, in addition to the ZEW index. These indicators don’t have much effect on the market, so traders could just ignore them. I’m inclined to believe that Tuesday’s technical factors will be more important than its fundamental ones.

Technical Analysis:

Intraday target maximum: 1.1405, minimum: 1.1343 (current Asian), close: 1.1370 or around 1.1340;

Intraday volatility for last 10 weeks: 121 points (4 figures).

The euro/dollar returned to the LB in Asia. The price rebounded and is trading around 1.1359 against a 1.1343 session minimum. It’s probable that we’ll see a depart to 1.1311, but I’ll take a chance in saying that we’ll see a growth of the euro to 1.1405. After the renewal of the maximum, I’ll be waiting for a return to 1.1370. If the forecast comes off, we could well be looking at having two new targets for 1.1340 and 1.1290 for Wednesday.

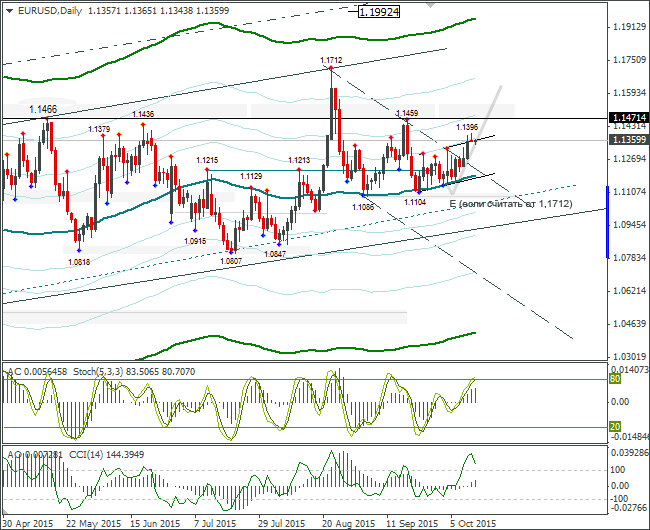

Daily

The eurobulls have shifted the maximum to 1.1396 in the thin market. I think that the buyers won’t be calmed down whilst the 1.1459-1.1471 zones haven’t been reached. For this there are price levels after a break in the trend line (measured using the Demark indicator). To cancel the bullish signal and chase the buyers from the market, a close of the day at 1.1271 or below is needed. Now to the Weekly.

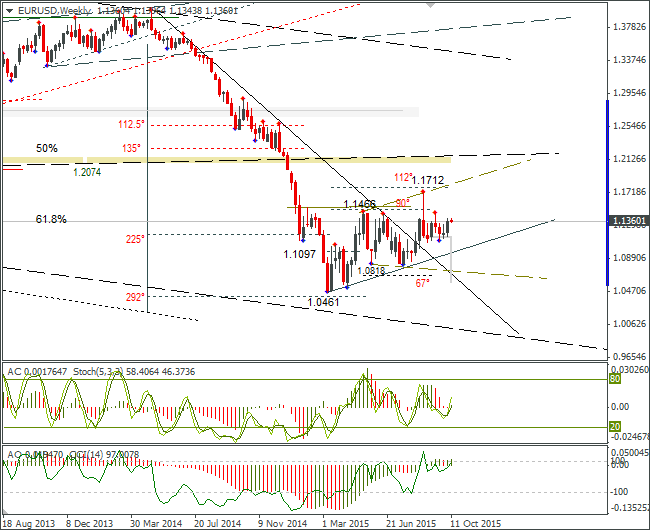

Weekly

The euro is shifting upwards to the upper limit of the 1.1086-1.1459 channel. We just need to wait for a depart or a break.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.