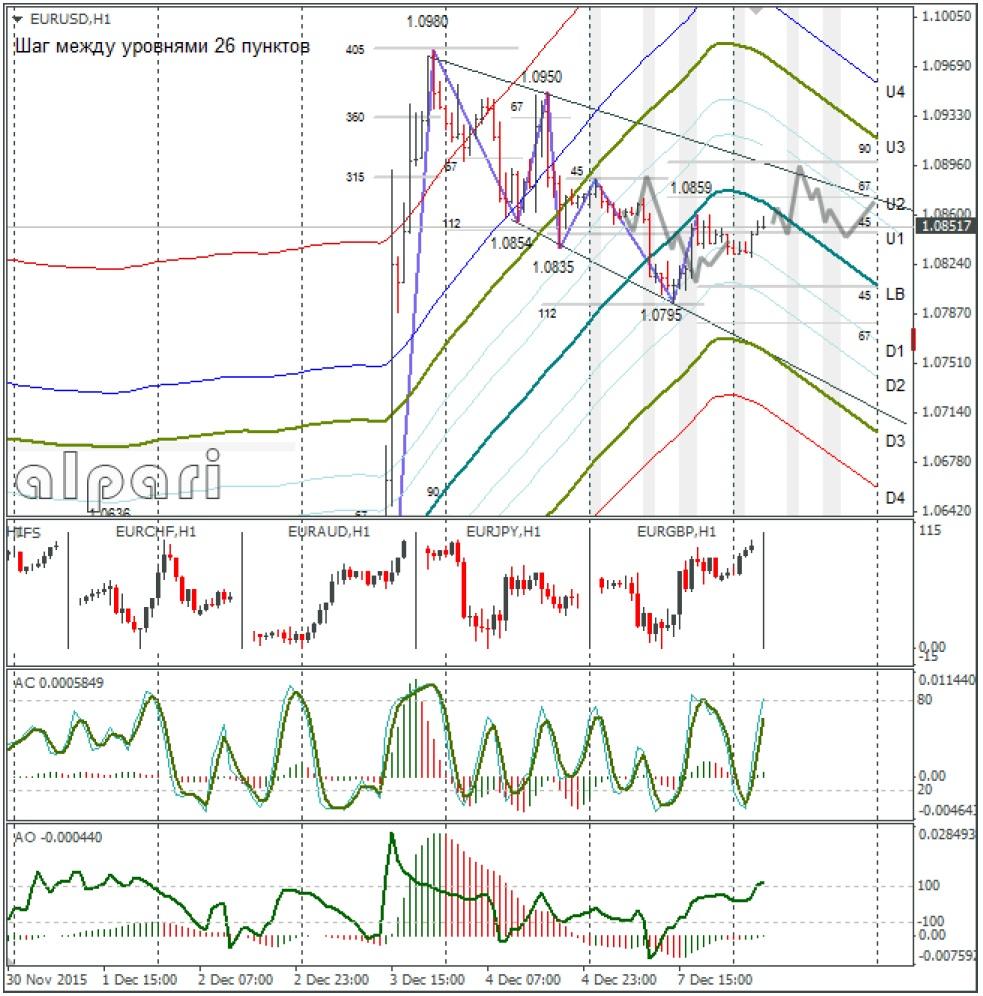

Hourly

Yesterday’s Trading:

Monday saw the euro/dollar reaching for the support at around 1.0800. The correction was 38.2% from the growth from 1.0518 to 1.0980. The calendar was empty, so the price easily returned to the balance line at 1.0859.

Main news of the day (EET):

11:30, UK industrial manufacturing and production in the manufacturing sector for October;

12:00 Eurozone Q3 GDP;

15:15, Canadian new housing orders for November and construction permits for October;

17:00, US job vacancies and labour turnover for October. UK GDP from NIESR for November;

19:50, Bank of Canada’s Poloz to speak.

Market Expectations:

Trader attention on Tuesday will be focussed on UK and Eurozone data. However, it’s the upcoming FOMC meeting that will set the scene on the market. The futures market assesses the likelihood of a US rate rise at around 80%. The market has already taken a rise into account, so it makes more sense to expect a consolidation at the levels reached (a wide flat) on the key pairs.

Technical Analysis:

Intraday target maximum: 1.0890, minimum: 1.0829 (current Asian), close: 1.0868;

Intraday volatility for last 10 weeks: 103 points (4 figures).

The euro/dollar is trading near the LB at 1.0849. The day closed above 1.0807, so I expect we’ll see a test of 1.0890. The falling price of oil and gold will impact the euro and so in the second half of the day I reckon we will see a rebound from 1.0890.

Daily

The euro/dollar closed down on Monday, but above 1.0807. The growth tendency is still alive and kicking. The falling oil and gold prices could hold off the euro bulls. Now to the Weekly.

Weekly

For the moment I am keeping an eye on market events and the formation of a double bottom.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.