Trading opportunities for currency pair: the monthly candle has closed the previous two months and will be closing down. The target is 1.4560. Due to the general strengthening of USD and according to the cycle, the pound/dollar’s fall could last until the beginning of March 2016. Since the scenario is a weekly one, it could become invalid if the weekly candle closes above 1.5340.

As things are at the moment:

The pound/dollar closed at 1.5030 against 1.5046. The pound strengthened to 1.5335 as part of an upward correction and then returned to where it was. The support remained unbroken with the weekly indicators showing a further fall for the GBP.

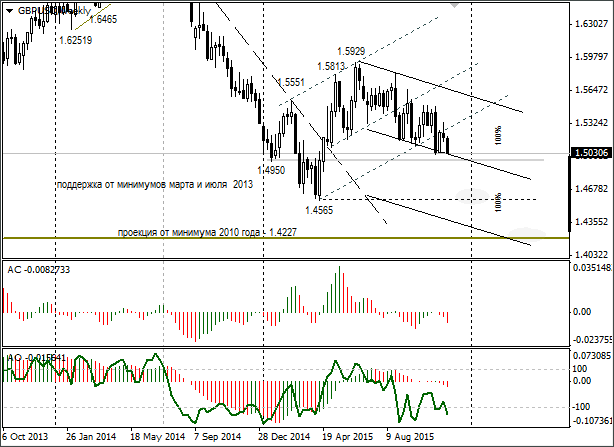

Weekly GBP/USD

After the broken trend line (dotted line), the pound couldn’t manage to win back its losses. The price returned to the support. All of the indicators (CCI, AC, and AO) are showing a further fall for the pound sterling. Just as before, I’m still waiting for the support to be broken. The first target is 1.4950 and after that the road to 1.4565 will open up.

We can expect a sharp fall of the GBP/USD if there is an upward inversion of the euro/pound cross. Don’t expect this inversion to come before 3rd December (ECB meeting).

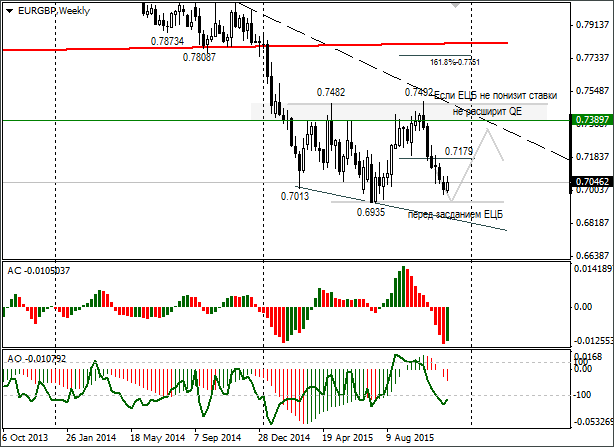

Weekly EUR/GBP

The price already takes account for a further relaxation of monetary policy. If the ECB disappoints the market, the euro/pound will flip downside up. After the ECB has convened, traders will be focussing their attention on Friday’s US labour market report and the FOMC meeting. Here I think we’ll see a double bottom. This pattern could be realized even if the ECB relaxed its monetary policy further.

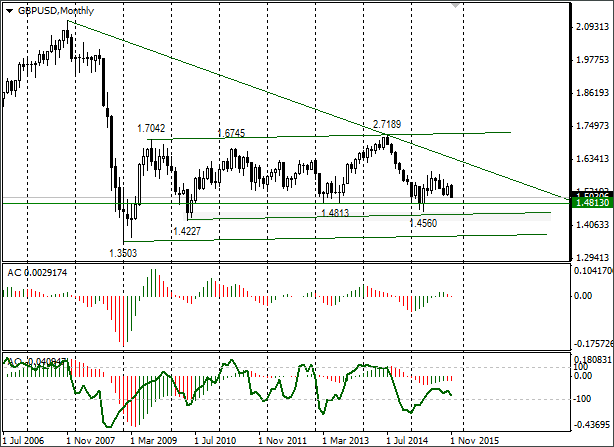

Monthly GBP/USD

The monthly candle will close on Tuesday. I’ve put this graph in the review to show you the full picture for the GBP/USD. It’s unlikely that anything will change over the course of Monday. For now, November has closed two previous candles and this is a bear signal.

If we put a line through the 1.7042 and 2.7189 maximums and then attach a parallel line to the 1.4227 minimum, we get a support at 1.4430. I took the target from April 2015’s minimum.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD turns south toward 0.6400 after mixed Australian jobs data

AUD/USD has come under renewed selling pressure and turned south toward 0.6400 after Australian employment data pointed to loosening labor market conditions, fanning RBA rate cut expectations and weighing on the Aussie Dollar.

USD/JPY remains below 154.50 amid weaker US Dollar

USD/JPY keeps losses for the second successive session, trading below 154.50 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone.

Gold retreats as lower US yields offset the impact of hawkish Powell speech

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve officials.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

US stock continue to stumble as traders rethink rates

US stocks grappled with uncertainty on Wednesday in the wake of a cautious string of commentary from the US Federal Reserve officials. The S&P 500 is currently experiencing its longest non-bullish streak in months.