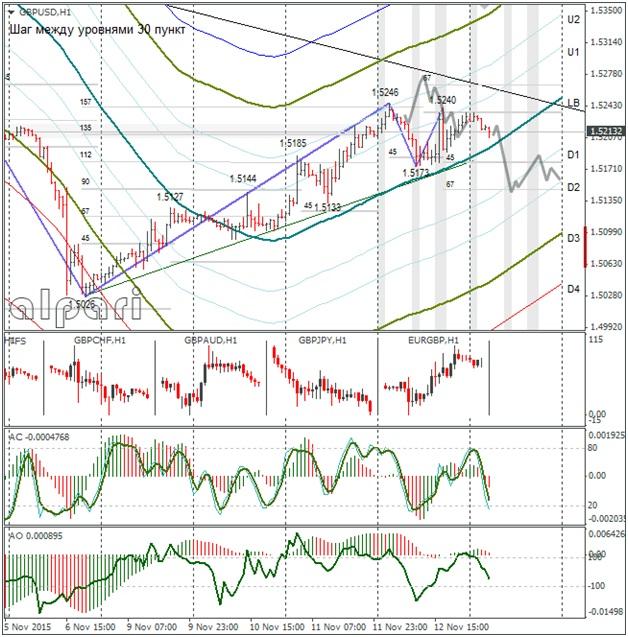

Hourly

On Thursday the pound/dollar was trading above the LB in a range of 70 points. In the first half of the day the rate dropped to 1.5173 and in the second it returned to 1.5240. It’s now at 1.5199. If European trading sees a break of the 1.5191 support (LB and trend), I’ll be expecting a weakening of the pound to the 67th degree at 1.5145 (technical signal without any fundamental news).

There is no important macro-economic data set to come out of the UK today. We could well see a calm correction against the growth from the 1.5026 minimum. The pound so far has corrected too high.

Daily

The pound/dollar has met the trend line with its wall (this trend line was broken on 6th November). The sellers now need to quickly strengthen below 1.5173 (yesterday’s minimum). This would allow them to push the buyers back to 1.5130 and from there we would have to take a look at the setup of market participants. If the buyers run from the market, it means that we will head to 1.5026, if not: we should assess what will come about on the 4h time frame.

Weekly

There’s no change o the weekly graph. The closest target is still at 1.4900.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD remains under pressure above 0.6400

AUD/USD managed to regain some composure and rebounded markedly from Tuesday’s YTD lows in the sub-0.6400 region ahead of the release of the Australian labour market report on Thursday.

EUR/USD holds above 1.0650 amid renewed selling pressure in US Dollar

The EUR/USD pair edges higher to 1.0672 on Thursday during the early Asian session. The recovery of that major pair is bolstered by renewed selling pressure in the US Dollar and a risk-friendly environment.

Gold retreats as lower US yields offset the impact of hawkish Powell speech

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve officials.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin price is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

Australia unemployment rate expected to rise back to 3.9% in March as February boost fades

Australia will publish its monthly employment report first thing Thursday. The Australian Bureau of Statistics is expected to announce the country added measly 7.2K new positions in March after the outstanding 116.5K jobs created in February.