Hourly

Yesterday’s Trading:

The dollar index closed Monday practically unchanged to that of Friday. What the Fed members had to say didn’t have much effect on movements across key pairs. Trading volume remained low since US and Canadian markets were closed due to it being Columbus day and Thanksgiving.

The euro/dollar was trading around 1.1369 and dropped to the LB at 1.1343 in Asia.

Main news of the day:

At 11:30 EET, German inflation figures for September will be out;

At 11:30 EET the UK CPI, RPI and PMI for September will be out;

At 12:00 EET, Germany’s ZEW index for business mood in October will be out.

Market Expectations:

Today’s intraday attention for traders will be focussed on the publication of inflation figures for Germany and the UK, in addition to the ZEW index. These indicators don’t have much effect on the market, so traders could just ignore them. I’m inclined to believe that Tuesday’s technical factors will be more important than its fundamental ones.

Technical Analysis:

Intraday target maximum: 1.1405, minimum: 1.1343 (current Asian), close: 1.1370 or around 1.1340;

Intraday volatility for last 10 weeks: 121 points (4 figures).

The euro/dollar returned to the LB in Asia. The price rebounded and is trading around 1.1359 against a 1.1343 session minimum. It’s probable that we’ll see a depart to 1.1311, but I’ll take a chance in saying that we’ll see a growth of the euro to 1.1405. After the renewal of the maximum, I’ll be waiting for a return to 1.1370. If the forecast comes off, we could well be looking at having two new targets for 1.1340 and 1.1290 for Wednesday.

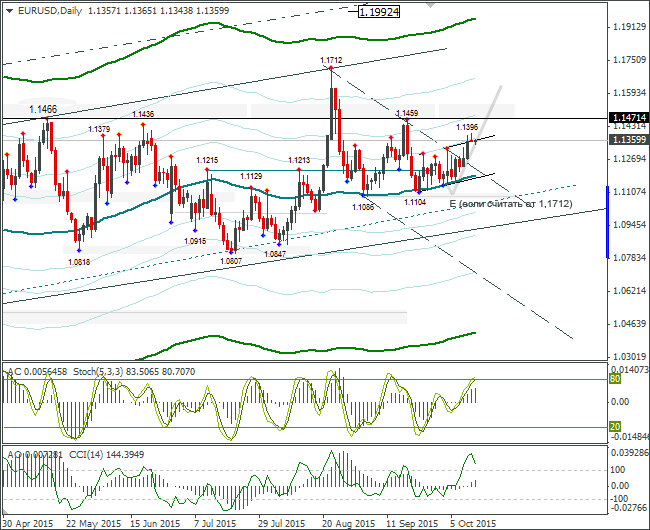

Daily

The eurobulls have shifted the maximum to 1.1396 in the thin market. I think that the buyers won’t be calmed down whilst the 1.1459-1.1471 zones haven’t been reached. For this there are price levels after a break in the trend line (measured using the Demark indicator). To cancel the bullish signal and chase the buyers from the market, a close of the day at 1.1271 or below is needed. Now to the Weekly.

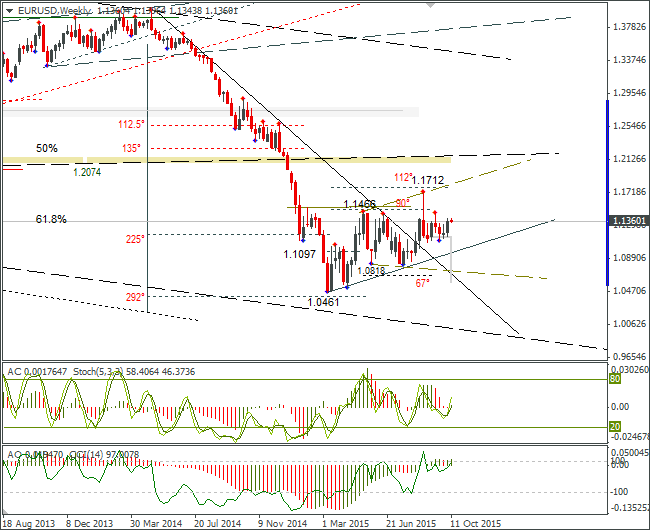

Weekly

The euro is shifting upwards to the upper limit of the 1.1086-1.1459 channel. We just need to wait for a depart or a break.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.