The non-policy decision by the BoJ, creates considerably uncertainty over when the BoJ will consider easing policy further. Kuroda suggests he simply needs more time to assess the effects of NIRP, in the order of six months or more, which pushes action out until at least late-July. It seems he and other policymakers are willing to live with a stronger JPY and a lull in economic conditions over coming months. In consideration of the rising trend in JPY this year, the risk is high that it continues to rally sufficiently to put pressure on the BoJ and government to act, and this may be closer to a USD/JPY level near 100. A stronger JPY has tended to spill over to a weaker USD more generally in the immediate wake of the non-policy easing. However, the sharp rise in JPY in early-February tended to add to global risk aversion and delayed the recovery in emerging market assets and currencies. Perhaps this time the shock value of a stronger JPY is less, and commodity markets are on a firmer footing, such that a stronger JPY may not dampen risk appetite as much. Nevertheless, the tendency for JPY to rally is likely to accentuate other possible global disturbances to risky assets, such as renewed concerns over China or Brexit vote. As such we might expect non-dollar risk havens, such as gold, to remain underpinned with upside risk.

BoJ care less about market expectations

The un-named officials at the BoJ that suggested there may be a cut in the rate that the BoJ lends money to banks to support their lending, thus opening the door for a further cut in the policy cash rate, were not as prescient as we had thought. This does not mean that this policy was not discussed internally at the BoJ, or that it may still be implemented at a later stage.

Kuroda and the policy making board were not overly swayed by market expectations leading into the meeting.

Some of those expectations were driven by Kuroda and un-named BoJ officials leading us to presume ahead of the meeting that the BoJ was deliberately building up market expectations to weaken the JPY, and they planned to deliver on those expectations to ensure the JPY sustained that weakness.

We must walk away from this meeting acknowledging that talk ahead of a BoJ meeting means less than we had thought. For talk to matter it probably needs to come from more sources, more named officials and be more persistent. We must be cautious that talk may just reflect the debate inside the BoJ and not reflect a plan to massage expectations.

It may have been the case that Kuroda was genuinely considering policy easing at this meeting but other factors prevented that action and he was prepared to let down market expectations. We presume he was not clueless to what those expectations were, but those other factors mattered more and Kuroda and the board cared less about the fallout from not meeting expectations.

In the past we thought that Kuroda was purposely shocking the market to give his policy easing greater impact and demonstrating a willingness to act fearlessly and with purpose to achieve his 2% inflation goal. After those shock tactics back-fired when he introduced NIRP in January, we though he was cleverly attempting to give the market a clearer understanding of how it should react by allowing it time to build-in a further rate cut, leaking the policy proposal ahead of the April meeting. There may still be some validity to these assumptions, other considerations may have delayed the rate cut, but we have to conclude that Kuroda and team are much less concerned with setting up market expectations to their advantage than we had earlier thought.

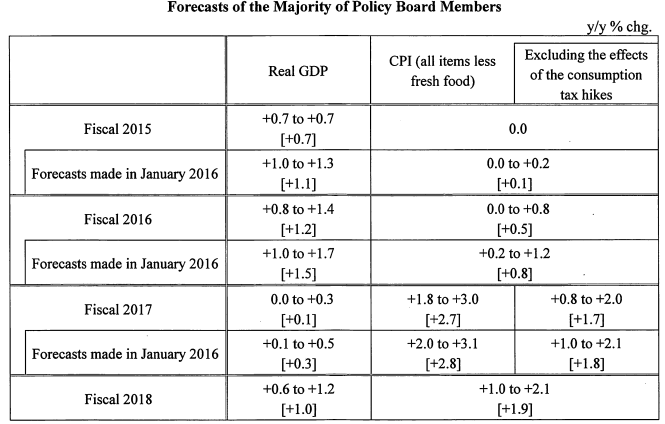

Downward revisions to growth and inflation

- Fiscal 2016 (year ending Mar-2017) GDP forecast revised down from 1.5% to 1.2%

- Fiscal 2017 GDP forecast revised down from 0.3% to 0.1%

- Fiscal 2016 inflation lowered from 0.1% to 0.0 (all items less fresh food , but including oil)

- Fiscal 2017 inflation lowered from 1.8% to 1.7%.

- Inflation “judged likely to achieve around 2% inflation during fiscal 2017”. The fourth time in a year that the bank has pushed back the target. In 2013, Kuroda first set the time frame as 2 years that has stretched now to 4 years.

What are they waiting for?

Some have surmised that Kuroda wanted to place more pressure on the government to refine its policy response to the recent deterioration in growth. This may include introducing a supplementary fiscal budget and/or accelerating reforms that might come under the third-arrow umbrella. If it is about reforms, it might mean that Kuroda is prepared to wait some time, well into the year, before considering further policy easing.

Kuroda may be holding back policy easing to time it with government fiscal policy expansion to give it more thrust in the hope that it might be more effective.

The lack of policy easing may reflect a sense at the BoJ that it is running out of policy ammunition and it needs to use it more judiciously for greater effect.

Kuroda himself may now think that he has pushed policy to extreme lengths and he is now more reluctant to take it further, fearing the unintended consequences of pushing too hard.

He may feel that the policy measures implemented to-date may be sufficient to achieve their goals but it just may take more time. He may think it is better to lengthen the time it takes to achieve 2% inflation to lessen risks of unintended consequences.

These arguments have gained ground with some other officials and staffers at the BoJ, and Kuroda and his dovish cohorts may have become more accepting of this view, or at least are prepared to be more patient, acknowledging the risks to financial stability related to excessive BoJ intervention in domestic asset markets that one day it must extract itself from.

There have also been those that have argued that 1% inflation in Japan is an acceptable and realistic target given the economy’s low growth potential. We suspect that Kuroda much prefers 2% and will maintain that goal, but he may secretly feel attaining that target is not the end-all and be-all. He may just accept that provided some inflation is becoming entrenched in expectations he can be much more patient in achieving 2%.

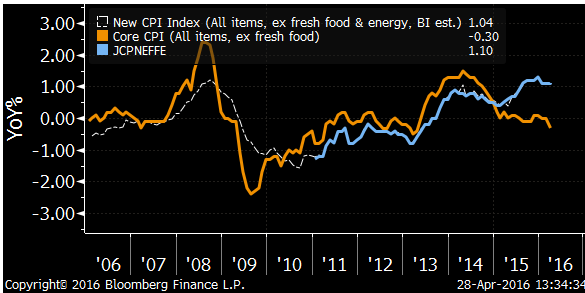

While the BoJ’s preferred underlying inflation measure, CPI less fresh food and energy, has stalled recently (1.1% in March), it has lifted from below zero in three years since Kuroda began his journey. And the BoJ is still recording a broadening number of items experiencing price increases.

A reason to be more patient in achieving 2% inflation remains the low global inflation. Japan is not alone in under-shooting a 2% target, there are substantial risks to the global growth outlook. It appears less realistic and dangerous to take the lead in pushing for higher inflation when monetary policy is already extremely easy.

Kuroda may have simply decided for political reasons, to keep a stronger consensus at his shoulders, in consideration of the extreme policy measures in place, the risks to financial stability and the global backdrop.

A Patient BoJ means a stronger JPY

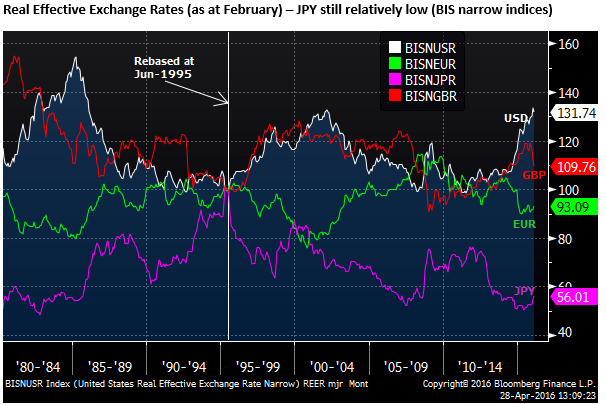

The implications of this thought process is that we might expect some further strength in the JPY. The BoJ and government obviously would like a weaker currency, but are exhibiting patience, are prepared to see the economy go through a lull and accept a period of strengthening JPY, up to some extent.

The USD/JPY was in the 70s in 2012 and is still much weaker. In real effective terms, over a long term scale, the JPY is regarded still as cheap and supporting Japanese traded goods and service sectors. A fall towards 100 would not be the end of the world, and may not evoke a significant policy response from the BoJ or government. The BoJ has not been moved by the drop below 110 to further ease policy, the market should presume it will not be moved until closer to 100, and much may depend on how the economy copes in the meantime.

Placing a time frame on inaction

The BoJ statements and comments from Kuroda suggest that they are still prepared to ease further. Their statement said, “The Bank will continue with Quantitative and Qualitative Easing (QQE) with a Negative Interest Rate aiming to achieve the price stability target of 2 percent, as long as it is necessary for maintaining that target in a stable manner. It will examine risks to economic activity and prices, and take additional easing measures in terms of three dimensions – quantity, quality, and interest rate – if it is judged necessary for achieving the price stability target.”

In his press conference, Kuroda said, “We have kept monetary policy on hold this time while the effects of quantitative easing with a minus interest rate sink in,” … “Those effects don’t appear in a month or two but I don’t think it’ll take as long as six months or a year.” …..“There is plenty, plenty of room to push down the negative rate,” …. “There is no change in our approach that we are going to do whatever is necessary.”

These statements sound forceful enough, but are little different than have been employed since 2013. However, they did place a time-frame on when the BoJ might consider further policy easing.

It is far from a promise and there are many moving parts in understanding what makes this BoJ tick, but he said I don’t think it will take as long as six months or a year. It’s a vague reference to time but it might suggest Kuroda will place more pressure on his team to ease further once it is six months or so on from the January rate cut. Sometime late in the summer perhaps.

If Kuroda is suggesting they will wait six months or so, it would seem unlikely they would move before the Upper House election expected sometime in July.

Alternatively, the BoJ may consider adding punch to its policy easing by timing it to coincide with government fiscal stimulus. The Government is expected to announce new spending and a possible further delay of its second round of consumption tax hikes that were slated for April next year.

There is market speculation that he will move on fiscal stimulus near the G7 summit Japan is hosting in late May. It is unclear if the government would also make a decision on the consumption tax hike at that time.

If Kuroda wanted to time policy to roughly coincide with fiscal stimulus he might be inclined to act at the next scheduled BoJ policy on 16 June. This would be just after the 15 June US FOMC policy meeting, not long before the 23 June UK Brexit referendum.

However, given that the Kuroda has said he wants to give it more time to assess the impact of his NIRP implemented in January, it would be a surprise he were to move on policy in June. The next policy meeting scheduled for 29 July may be just after the Upper House elections, again timed just after the FOMC meeting on 27 July. It seems a more likely time at this stage.

The BoJ and government may hope that the ongoing prospect of further BoJ policy easing, and fiscal stimulus measures by the government might prevent a significant further rise in the JPY. But they are equally unlikely to do much about it if the JPY strengthens further in the next few months.

As such, with the current rising trend in JPY, the lack of policy action at this juncture, a lack of clarity on what may move the BoJ suggests that the risk is high of further gains in JPY.

Wider implications of a stronger JPY – weighs on USD but also risk appetite

So far the sharp fall in USD/JPY on Thursday has spilled over to weaker Japanese equities, but it has not unduly undermined global risk appetite with equities in other markets relatively stable.

It appears to have spilled over into broader USD weakness, with decent gains in other Asian currencies.

Perhaps independently iron ore and steel prices bounced back from recent falls and oil prices have continued to trend higher, tending to contribute to broader gains in emerging market and commodity currencies.

When USD/JPY fell sharply in the wake of the 29 Jan BoJ NIRP policy decision, oil prices fell sharply and the rise in JPY appeared to add to global risk aversion. There is some risk that it does so again this time, although that remains to be seen.

Perhaps the shock value of a stronger JPY is not as great now, and provided it is not too rapid, global risk appetite will not be greatly affected. It is possible that a gradual decline in the USD/JPY may tend to drag on the USD more generally.

However, the tendency for JPY to strengthen in times of global financial stress may dominate and accentuate rather than dampen the impact of other global risk factors such as developments in China, should they flare-up.

As such, we may see a solid performance with upside risk for non-dollar risk havens, such as gold.

AmpGFX publications and all material in this website is intended to provide general advice, and does not purport to make any recommendation that any foreign exchange, financial market securities or derivatives transaction is appropriate to your particular investment objectives, financial situation or particular needs. The information that we provide (or that is derived from our website) is not, and should not be construed in any manner to be, personalized advice. Trading in foreign exchange, financial securities and derivatives can involve substantial risk. The information that we provide or that is derived from our website should not be a substitute for advice from an investment professional. We encourage you to obtain personal advice from your professional investment advisor and to make independent investigations before acting on the information that you obtain from AmpGFX or derived from our website. Only you can determine what level of risk is appropriate for you.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.