Pound bounced sharply from a daily low of 1.4193 against the greenback, and trades around its daily opening. The improved market sentiment which fueled local share markets after the long holiday, is helping the UK currency to retain its latest gains, despite the lack of local macroeconomic data.

Later on today, FED's Yellen will speak of monetary policy in a private event, and investors will be looking there for her wording, given that after the ultra-dovish tone of the latest FOMC statement, officers have been for the most hawkish, pledging to remain in the tightening path. If Yellen boards the hawkish train, the dollar may get a strong boost across the board.

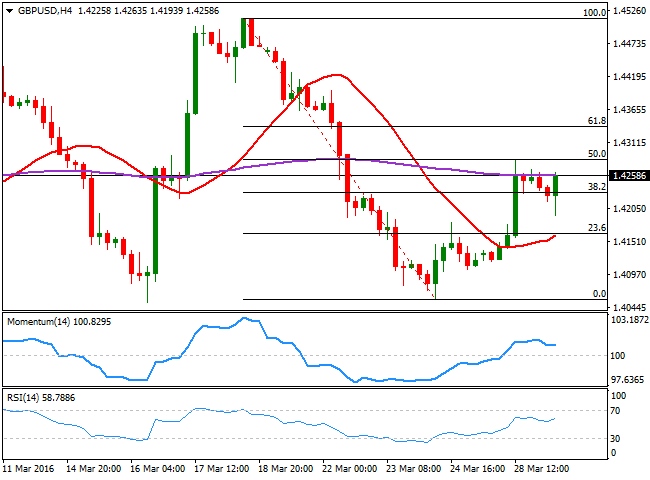

In the meantime, the 4 hours chart shows that the GBP/USD pair presents a bullish tone, with the price advancing firmly above a bullish 20 SMA, and the technical indicators regaining the upside within positive territory. Also, the price us currently aiming to recover above its 200 EMA, after breaking below it late last week.

At this point, the price needs to advance above 1.4285, the 50% retracement of the latest daily decline, to confirm additional gains up to the 1.4330/40 region, the 61.8% retracement of the same decline. Deeps are being seen as buying opportunities, with only a downward extension below the mentioned daily low supporting a continued decline towards 1.4140.

View the live chart of the GBP/USD

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.