The British Pound have just hit a fresh 3-month low against the greenback at 1.5309, following the release of poor UK data.

In Britain, the August Markit Manufacturing PMI slipped to 51.5, against expectations of another advance up to 52.0, whilst the Consumer Credit in July shrunk to £1.173B from its previous £1.22B. Mortgage approvals rose to near 69K, all of which suggests that the economic growth may get a set back during the second quarter.

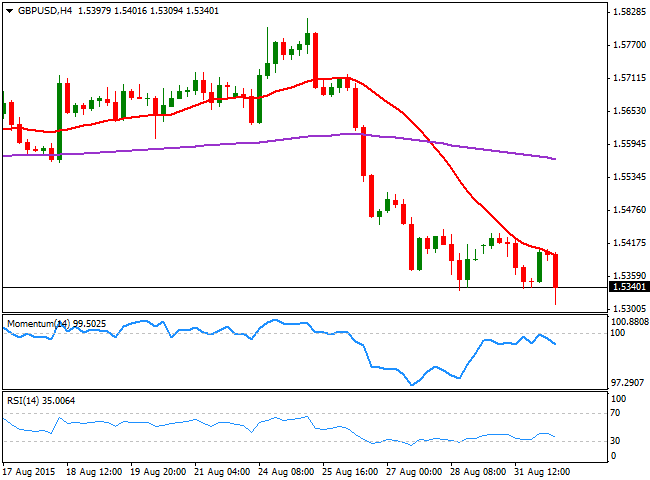

The bearish trend remains firm in place, and the pair has now scope to test the 1.5250 region, a strong long term static support level. Technically, the 4 hours chart shows that the price has been rejected from a strongly bearish 20 SMA, currently around 1.5400, whilst the technical indicators have resumed their declines below their mid-lines. Daily basis, the pair has set a lower low and a lower high, supporting the ongoing negative tone, albeit the day is not over yet.

Nevertheless, a break below the 1.5300 level should see a test of the mentioned 1.5250 price zone, whilst below this last, 1.5220 is the next short term support. Above 1.5360, the pair may retest the 1.5400 level, where selling interest is expected to resume.

View the live chart of the GBP/USD

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.