Growth numbers from the second quarter in the UK were not revised. The pound weakened further after the report. The GBP/USD dropped to 1.5363 and remains below 1.5400 under pressure.

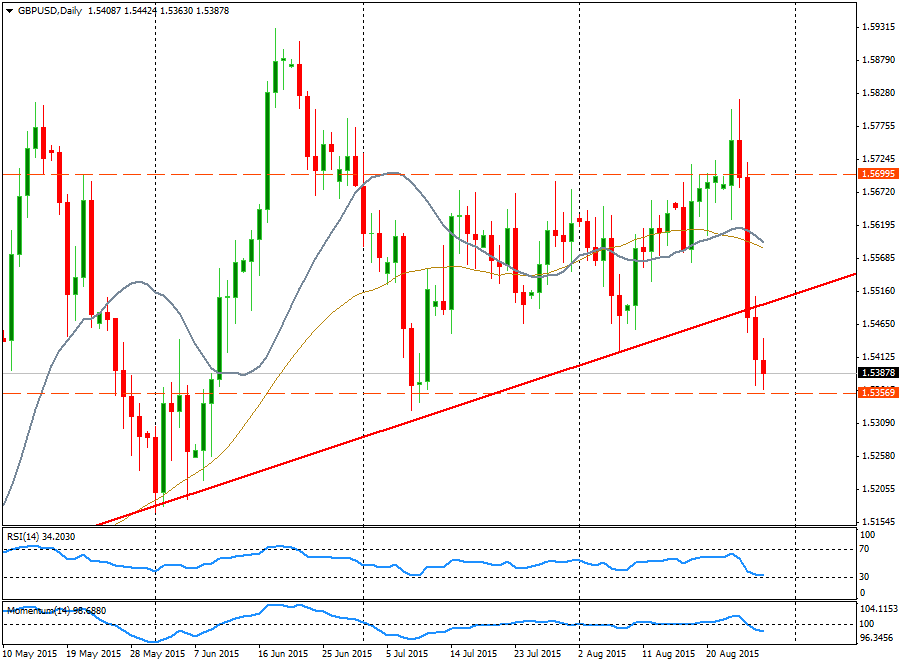

After being rejected from above 1.5700 and making a sharp reversal, the pair broke an uptrend line and dropped back to the previous trading range. Now testing a relevant support that capped the decline on July and worked as a resistance in the past. A break of the 1.5350 area should open the doors for further losses, with targets at 1.5300 and then around 1.5200. June lows should offer support.

The area around 1.5360 seems like a strong support from where a bounce to the upside is possible. So far the bounce from the lows has been limited. If it gains momentum it could rise to 1.5450/60; only above it could remove some of the bearish momentum and would open the doors toward 1.5500.

The pair is about to post the first close under the weekly 20-SMA; the negative signal could be offset if it manages to end above 1.5350. But anyway the outlook remains bearish after the reversal and the break of an uptrend line. A close on top of 1.5500 would remove strength to the US dollar.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.