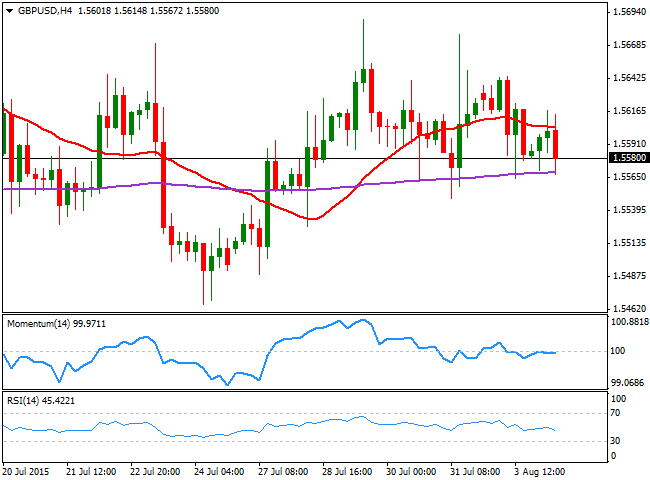

The GBP/USD pair remains stuck around the 1.5600 figure, weakening after the release of the UK Markit construction PMI that fell in July to 57.1 after hitting a four-month high of 58.1 in June. Nevertheless, the pair continues to trade above its 200 EMA in the 4 hours chart, around 1.5565, with the level attracting short term buyers ever since the week started.

However, the pair is unable to extend gains beyond the 1.5600 level, which maintains the risk towards the downside, particularly on a break below the mentioned 20 SMA. In the same chart, the Momentum indicator maintains a neutral stance, although the RSI indicator heads south around 45, supporting the short term view and favoring a decline towards the 1.5500/20 price zone.

At this point, the pair needs to establish above 1.5630 to be able to extend its rally up to the 1.5670 price zone, where strong selling interest capped the upside for most of last July.

.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.