The British Pound is under pressure after the release of the UK manufacturing PMI down to 51.4 in June against expectations of 52.5. The manufacturing sector grew at its weakest rate in more than two years, weighed by subdued export demand from Europe.

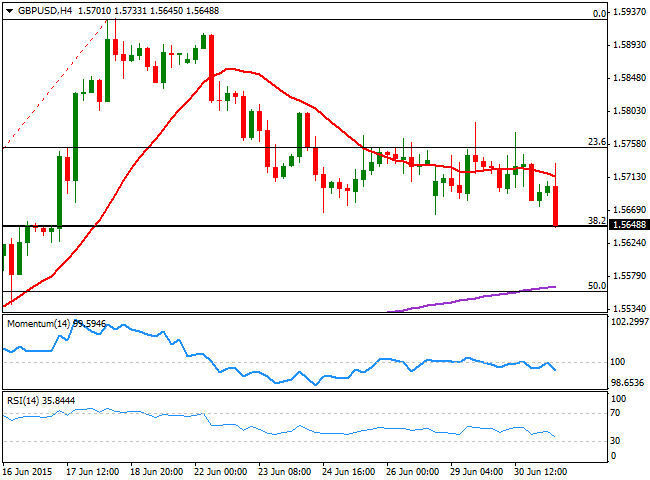

The GBP/USD accelerated south and pressures the 1.5645 strong static support, the 38.2% retracement of the latest bullish run, with the pair poised to extend its decline on a break below it. The 4 hours chart shows that the technical readings support such decline, as the price extended below its 20 SMA whist the technical indicators are gaining bearish momentum below their mid-lines. A break below the level should lead to a test of the 1.5600 figure, in route to 1.5550, the 50% retracement of the same rally.

The immediate resistance comes at 1.5700, with some steady gains above the level required to revert the negative tone intraday, and signaling a probable recovery up to the 1.5750 region.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

AUD/USD pressured as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.