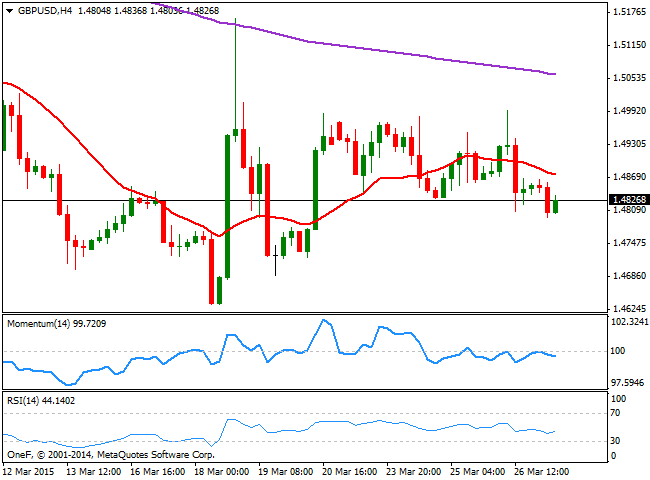

Technically, the pair maintains a bearish bias, as the 4 hours chart shows that the price stands well below a bearish 20 SMA, currently around 1.4870, whilst the Momentum indicator retraces from the 100 level and heads south and the RSI indicator hovers directionless around 42. The pair however, will likely consolidate ahead of the news, with a price acceleration below the 1.4785 level favoring additional declines towards the 1.4730 price zone in the short term. The upside seems more limited, with some follow through above the mentioned 1.4870 level required to confirm another leg higher towards the 1.4920/40 price zone.

View Live Chart for GBP/USD

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.