The GBP/USD pair is bouncing from a fresh 2-week low established at 1.5580, barely holding above the 1.5600 level ahead of the US employment data to be released in a couple of hours. The Pound found support in local construction data, showing that the sector rebounded in June, from the almost two year low posted in April, according to the latest Construction PMI reading, up to 58.1. At the same time, the Nationwide Housing Prices report for June, showed that the annual pace of house prices slowed in June, moderating to 3.3% from 4.6% in May. Lower prices are positive for the GBP as the BOE fears a housing bubble due to strong surge in price over the last two years.

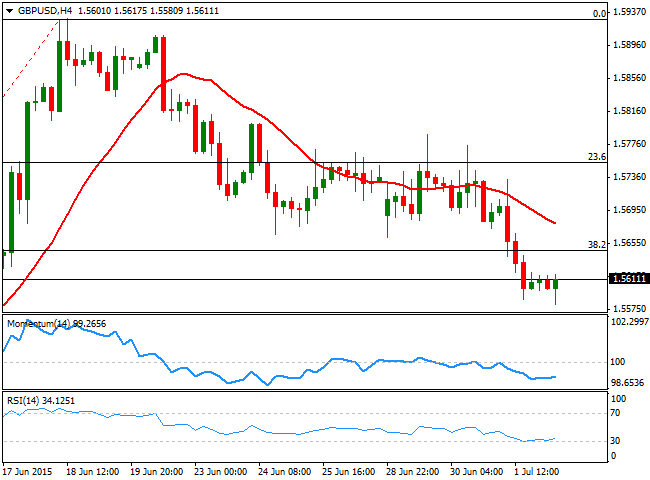

Technically, the pair maintains a negative tone according to its 4 hours chart, as the price is far below its 20 SMA, whilst the technical indicators are barely bouncing from oversold territory. The upcoming direction will be solely dependent on US data, with a negative reading probably triggering a stronger reaction in the pair than a positive one. Should the numbers disappoint, the key resistance level to watch comes at 1.5645, the 38.2% retracement of the latest daily run, as a recovery above it should lead to a continued advance up to the 1.5690/1.5700 region.

To the downside, the main support stands at 1.5550, the 50% retracement of the same rally, with a break below it exposing the pair to a decline down to 1.5480/1.5500.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

EUR/USD comes under pressure near 1.0630

Further gains in the Greenback encourage sellers to maintain their control over the risk complex, forcing EUR/USD to retreat further and revisit the 1.0630 region as the US session draws to a close.

GBP/USD stays firm amid BoE, Fed commentary and US data

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.