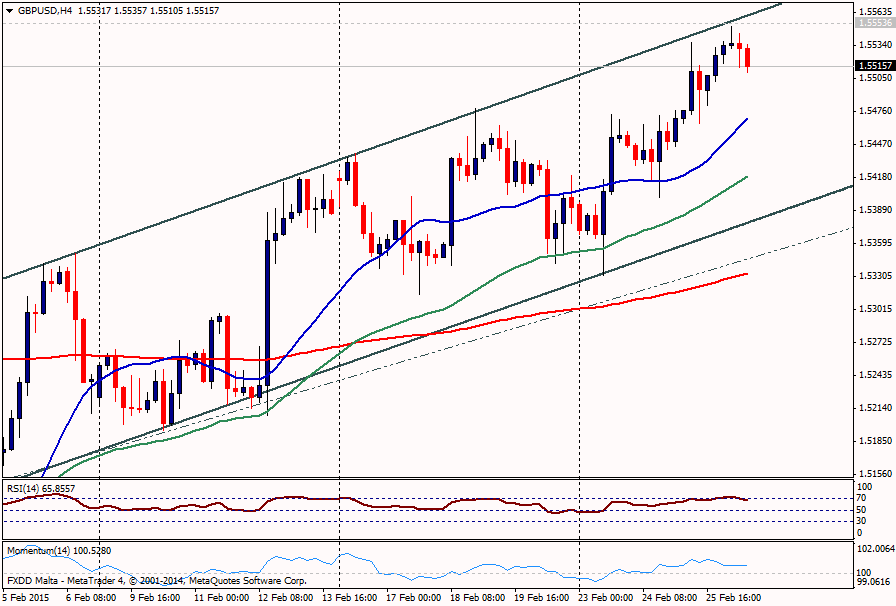

The short term trend and momentum still favors the upside, with price holding above key moving averages, but to open the doors for further gains price needs to break 1.5550 - 1.5560 that is the key resistance for the coming sessions. Above here it could accelerate and it is likely to move toward 1.5600 (on top of 2015 highs); above the next strong resistance is seen at 1.5680/85.

In the hourly chart the pair is moving to the downside, with the pair correcting after rising more than 200 pips from weekly lows. The correction could continue but it could be seen as an opportunity to buy the cable again. The immediate support level that should cap the decline lies at 1.5470 and below at 1.5420. Only a consolidation below 1.5370 could change the bullish outlook.

View Live Chart for GBP/USD

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.