Published at 05:51 (GMT) 26 Mar

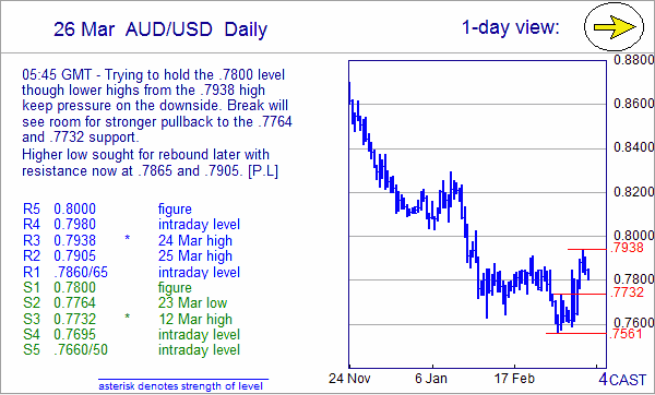

26 Mar AUD/USD Daily

Trying to hold the .7800 level though lower highs from the.7938 high keep pressure on the downside. Break will see room for stronger pullback to the .7764 and .7732 support. Higher low sought for rebound later with resistance now at .7865 and .7905. [P.L]

R5:: .8000 figure

R4: .7980 intraday level

R3: .7938 * 24 Mar high

R2: .7905 25 Mar high

R1: .7860/65 intraday level

S1: .7800 figure

S2: .7764 23 Mar low

S3: .7732 * 12 Mar high

S4: .7695 intraday level

S5: .7660/50 intraday level

Copyright and other intellectual property rights in the material in this report belong to FXMarketAlerts, 4Cast Limited, 4Cast Inc and/or Forecast pte ("4Cast"). The material shall not, under any circumstances, be reproduced or distributed in whole or part without the prior written consent of 4Cast.

The material in this report is based upon information which 4Cast considers to be reliable and the analysis and opinion in the material represents the view of 4Cast at the time of transmission (unless stated otherwise). Such analysis and opinion is subject to change without notice. The material is intended for use by parties knowledgeable and experienced in the financial sector and is only one source amongst others to be considered in carrying on their business or activity.

ACCORDINGLY 4CAST MAKES NO REPRESENTATION OR WARRANTY EXPRESS OR IMPLIED STATUTORY OR OTHERWISE (INCLUDING BUT NOT LIMITED TO) THE ACCURACY OF THE MATERIAL IN THIS EMAIL AND ON THE WEBSITE OR THE FITNESS FOR PURPOSE AND ALL SUCH REPRESENTATIONS AND WARRANTIES ARE HEREBY EXPRESSLY EXCLUDED.

4Cast does not give or purport to give investment advice. Any action taken by users on the basis of material on this website is entirely at their own risk. Independent investment advice should be sought where appropriate.

This email and the website may link to or be linked to other internet sites. 4Cast does not accept responsibility for the content of such other sites.

4Cast’s terms and conditions of business apply to all fee paying subscribers and authorised trial users.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.