Published at 06:51 (GMT) 02 Mar

UK Nationwide house prices for Feb -0.1%m/m, vs +0.3% expected; +6.7%y/y vs +6.1% expected.

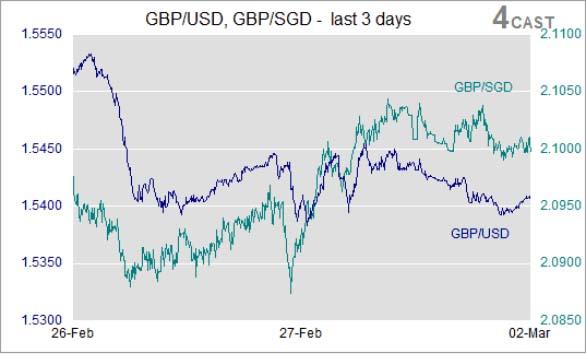

On FX, little impact on GBP/USD, now at 1.5400-03. With BoE watching house price closely, and the government as well. Likely a hot topic ahead of the May 7 elections.

GBP/USD offers at 1.5450/1.5500. Bids at 1.5380-00, eye any SWF, sovereign, M.E., Asian, M+A related and real money corporate demands on dips. GBP/USD supported by EUR/GBP sales to 7-year lows 0.7235.

GBP/SGD back above key 2.1000 handle. As GBP, GBP/Crosses remain resilient, despite the broadly firmer Greenback - USD/Majors, USD/Regionals. GBP/SGD eye 7-month highs of 2.1060-70 seen on Feb 26, highest level since August 8 2014, 2.1095. GBP/SGD seen in range of 2.05-2.15 on the wide. USD/SGD at 1.3635-40, near the 4-year 6-month highs 1.3657. Eye any MAS rumours of rallies ahead of 1.37 handle. bids at 1.3580-00.

Copyright and other intellectual property rights in the material in this report belong to FXMarketAlerts, 4Cast Limited, 4Cast Inc and/or Forecast pte ("4Cast"). The material shall not, under any circumstances, be reproduced or distributed in whole or part without the prior written consent of 4Cast.

The material in this report is based upon information which 4Cast considers to be reliable and the analysis and opinion in the material represents the view of 4Cast at the time of transmission (unless stated otherwise). Such analysis and opinion is subject to change without notice. The material is intended for use by parties knowledgeable and experienced in the financial sector and is only one source amongst others to be considered in carrying on their business or activity.

ACCORDINGLY 4CAST MAKES NO REPRESENTATION OR WARRANTY EXPRESS OR IMPLIED STATUTORY OR OTHERWISE (INCLUDING BUT NOT LIMITED TO) THE ACCURACY OF THE MATERIAL IN THIS EMAIL AND ON THE WEBSITE OR THE FITNESS FOR PURPOSE AND ALL SUCH REPRESENTATIONS AND WARRANTIES ARE HEREBY EXPRESSLY EXCLUDED.

4Cast does not give or purport to give investment advice. Any action taken by users on the basis of material on this website is entirely at their own risk. Independent investment advice should be sought where appropriate.

This email and the website may link to or be linked to other internet sites. 4Cast does not accept responsibility for the content of such other sites.

4Cast’s terms and conditions of business apply to all fee paying subscribers and authorised trial users.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.