Published at 05:56 (GMT) 02 Mar

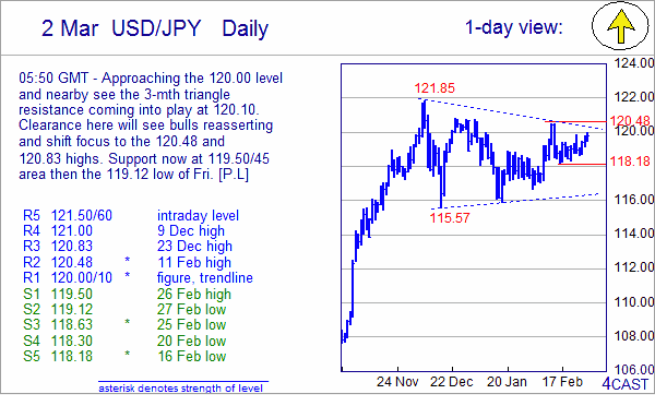

02 Mar USD/JPY Daily

Approaching the 120.00 level and nearby see the 3-mth triangle resistance coming into play at 120.10. Clearance here will see bulls reasserting and shift focus to the 120.48 and 120.83 highs. Support now at 119.50/45 area then the 119.12 low of Fri. [P.L]

R5:: 121.50/60 intraday level

R4: 121.00 9 Dec high

R3: 120.83 23 Dec high

R2: 120.48 * 11 Feb high

R1: 120.00/10 * figure, trendline

S1: 119.50 26 Feb high

S2: 119.12 27 Feb low

S3: 118.63 * 25 Feb low

S4: 118.30 20 Feb low

S5: 118.18 * 16 Feb low

Copyright and other intellectual property rights in the material in this report belong to FXMarketAlerts, 4Cast Limited, 4Cast Inc and/or Forecast pte ("4Cast"). The material shall not, under any circumstances, be reproduced or distributed in whole or part without the prior written consent of 4Cast.

The material in this report is based upon information which 4Cast considers to be reliable and the analysis and opinion in the material represents the view of 4Cast at the time of transmission (unless stated otherwise). Such analysis and opinion is subject to change without notice. The material is intended for use by parties knowledgeable and experienced in the financial sector and is only one source amongst others to be considered in carrying on their business or activity.

ACCORDINGLY 4CAST MAKES NO REPRESENTATION OR WARRANTY EXPRESS OR IMPLIED STATUTORY OR OTHERWISE (INCLUDING BUT NOT LIMITED TO) THE ACCURACY OF THE MATERIAL IN THIS EMAIL AND ON THE WEBSITE OR THE FITNESS FOR PURPOSE AND ALL SUCH REPRESENTATIONS AND WARRANTIES ARE HEREBY EXPRESSLY EXCLUDED.

4Cast does not give or purport to give investment advice. Any action taken by users on the basis of material on this website is entirely at their own risk. Independent investment advice should be sought where appropriate.

This email and the website may link to or be linked to other internet sites. 4Cast does not accept responsibility for the content of such other sites.

4Cast’s terms and conditions of business apply to all fee paying subscribers and authorised trial users.

Recommended Content

Editors’ Picks

AUD/USD holds hot Australian CPI-led gains above 0.6500

AUD/USD consolidates hot Australian CPI data-led strong gains above 0.6500 in early Europe on Wednesday. The Australian CPI rose 1% in QoQ in Q1 against the 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY sticks to 34-year high near 154.90 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US macro data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.