Published at 13:20 (GMT) 29 Aug

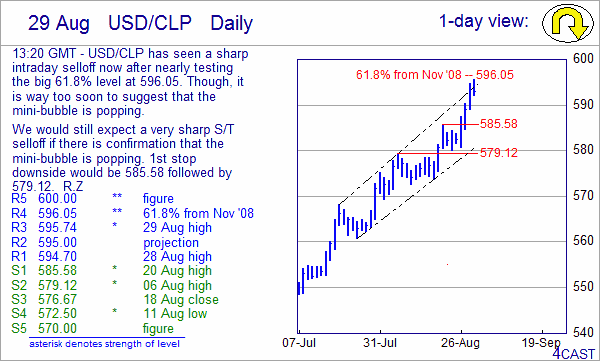

13::20 GMT - USD/CLP has seen a sharp intraday selloff now after nearlytesting the big 61.8% level at 596.05. Though, it is way too soon to suggest that the mini-bubble is popping. We would still expect a very sharp S/T selloff if there is confirmation that the mini-bubble is popping. 1st stop downside would be 585.58 followed by 579.12. R.Z

R5: 600 ** figure

R4: 596.05 ** 61.8% from Nov '08

R3: 595.74 * 29 Aug high

R2: 595 projection

R1: 594.7 28 Aug high

S1: 585.58 * 20 Aug high

S2: 579.12 * 06 Aug high

S3: 576.67 18 Aug close

S4: 572.5 * 11 Aug low

S5: 570 figure

Copyright and other intellectual property rights in the material in this report belong to FXMarketAlerts, 4Cast Limited, 4Cast Inc and/or Forecast pte ("4Cast"). The material shall not, under any circumstances, be reproduced or distributed in whole or part without the prior written consent of 4Cast.

The material in this report is based upon information which 4Cast considers to be reliable and the analysis and opinion in the material represents the view of 4Cast at the time of transmission (unless stated otherwise). Such analysis and opinion is subject to change without notice. The material is intended for use by parties knowledgeable and experienced in the financial sector and is only one source amongst others to be considered in carrying on their business or activity.

ACCORDINGLY 4CAST MAKES NO REPRESENTATION OR WARRANTY EXPRESS OR IMPLIED STATUTORY OR OTHERWISE (INCLUDING BUT NOT LIMITED TO) THE ACCURACY OF THE MATERIAL IN THIS EMAIL AND ON THE WEBSITE OR THE FITNESS FOR PURPOSE AND ALL SUCH REPRESENTATIONS AND WARRANTIES ARE HEREBY EXPRESSLY EXCLUDED.

4Cast does not give or purport to give investment advice. Any action taken by users on the basis of material on this website is entirely at their own risk. Independent investment advice should be sought where appropriate.

This email and the website may link to or be linked to other internet sites. 4Cast does not accept responsibility for the content of such other sites.

4Cast’s terms and conditions of business apply to all fee paying subscribers and authorised trial users.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.