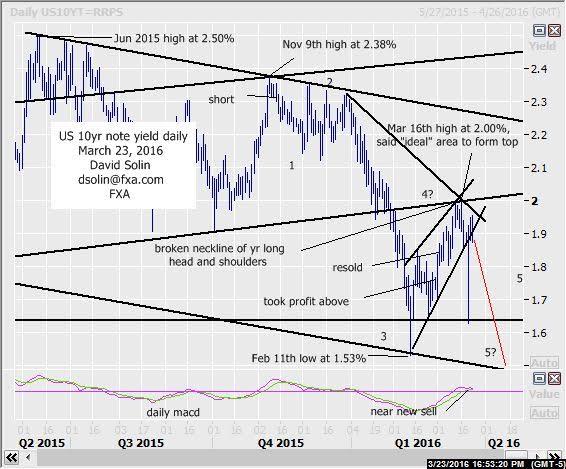

Near term US 10 year note yield outlook:

In the Mar 16th email and the market near its recent highs at 2.00% (both a 50% retracement from the June 2015 high at 2.50% and the broken neckline of the year long head and shoulders pattern) , said it was an "ideal" to form a more important top and the market has indeed turned lower since. Note that the whole upmove from the Feb 11th spike low at 1.53% is seen as a correction (wave 4 in the decline from Nov 9th high at 2.38%) and with eventual declines below that 1.53% after (within wave 5). Additionally, technicals are turning over (near new sell signal on the daily macd for example), the market is finally breaking below that bullish trendline from the Feb low and the S&P 500 may be approaching an important peak, with all supporting the view of top in the US 10 yr yield. Nearby support is seen at 1.75/77%. Bottom line: potentially important top at the recent 2.00% high and with eventual declines below that Feb 11th spike low at 1.53% after.

Strategy/position:

Still short from the Mar 3rd resell at 1.83%, and for now would stop on a close .02 above that bearish trendline from Dec 30th.

Long term outlook:

As discussed above, declines below that Feb 11th low at 1.53% are favored and fits the very long held, long term view of an extended period of wide, ranging lower (years and good sized, countertrend bounces) as the market continues to form that huge falling wedge since 2003. These patterns break down into 5 legs and continues to target eventual declines below that June 2012 low at 1.38%. However, there is some risk for only limited lows below 1.53% and a more extended period of ranging (months), before those new lows are finally seen (see in red on weekly chart/2nd chart below). Key resistance remains at the ceiling of the huge wedge (currently just above that June 2015 high at 2.50%) as a break/close clearly above would argue that a more major bottom (years) is finally in place. Bottom line : still in large falling wedge since 2003 with long held view of declines below that June 2012 low at 1.38% still favored (some risk for a more extended period of ranging first).

Strategy/position:

Switched the longer term bias to the bearish side way back on Dec 17th at 2.09% for eventual declines below that June 2012 low at 1.38%. But with some risk for a more extended period of ranging first, will be quick to reassess on declines below that Feb low at 1.53%.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.