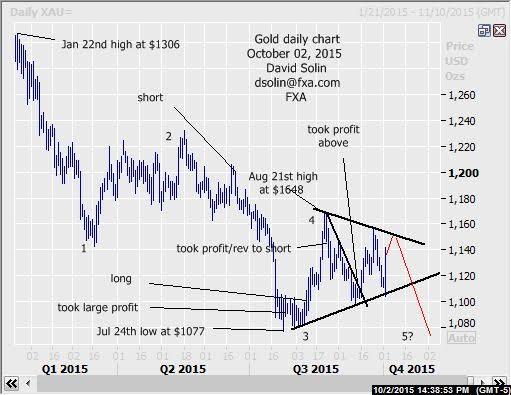

No change in the very long held view of a major bottoming in the $1075 area (for at least 6-9 months or more, see longer term below), with the choppy trade over the last few months part of the process. Nearer term however, the downside pattern from the Jan high at $1306 is still not "complete", with the action from the July low at $1077 seen as a correction (wave 4, potential triangle/pennant), and suggesting new lows after (within wave 5, see in red on daily chart below). A couple of notes...triangles tend to resolve sharply and further downside below $1077 would be seen as part of a more major bottoming, so such a downside resolution may be a short-lived spike before quickly reversing. Nearby support is seen at the base of the triangle (currently at $1100/05, earlier low), resistance is seen at the ceiling/bear trendline from the Aug 21st high (currently at $1154/57, clear break/close above would be a near term positive sign). A final comment, looks like commodities (oil, copper, etc.) may be store for a final downside washout over the next month or so and fits the view of a final downleg (potential spike lower) in gold. Bottom line : downside resolution of multi-month triangle favored, with potential quick spike below $1077 (as part of a more major bottoming).

Strategy/position:

Still short from the Sept 18th resell at $1138. For now would continue to stop on a close $3 above the ceiling of the triangle. But with the downside resolution potentially a short lived spiked, will want to quickly get much more aggressive with trailing stops on such a move lower, to reflect that risk (and maintain a good overall risk/reward in the position).

Long term outlook:

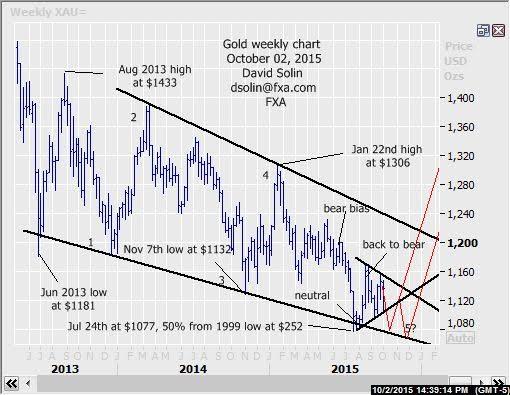

As discussed above, that very long held view of a potentially major bottoming (6-9 months or more) in that long discussed "ideal" area near $1075 still playing out, as the market continues to form that huge falling wedge over the last few years. These are generally viewed as bottom/reversal patterns and suggests an eventual (and potentially sharp) upside resolution of the ceiling (see in red on weekly chart/2nd chart below). Additionally, the seasonal chart is higher into next year (see 4th chart below) while silver is forming a similar bottoming/reversal pattern (see 3rd chart below, would use one to confirm the other). But as discussed above, there remains scope for a further period of a larger ranging/basing before such a final low is seen (see in red on weekly chart/2nd chart below). Key support remains in that $1065/80 area (both the base of the wedge and the a 50% retracement from the 1999 low at $252). A final comment, markets will at times resolve lower from these patterns. Though this is not currently favored, a clear break/close below the base of the wedge would increase the likelihood, and be a bigger picture bearish sign, Bottom line : in process of a major bottoming near that $1075 area (near the base of the 2 year falling wedge), but scope for more extended period of ranging/basing first.

Strategy/position:

Switched the longer term bias back to the bearish side on Aug 25th at $1140. But will also be looking for further signs/higher confidence of a more major bottom in that $1075 area to reverse. Also will use the same exit as the shorter term above (close $3 above that bearish trendline from Aug, would increase the likelihood of a more important bottom).

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.