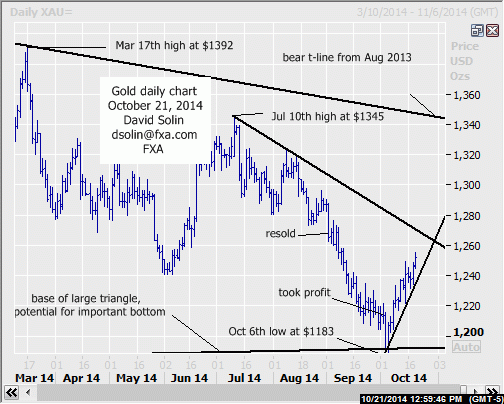

Gold near term outlook:

The market has indeed continued to rally from that Oct 6th spike low at $1183, the long discussed downside target/area to form important low over the last number of months (base of that long discussed triangle/pennant since June 2013, see longer term below). Currently, the market remains firm and is pushing to levels not seen in nearly a month. Though still a bigger picture bull, the market is approaching near term overbought after the last few weeks of sharp gains. Note too that a number of other "related" markets are not confirming these recent gains in gold, and appear to need further lows before forming more important bottoms. They include silver, the GDX (gold miners equity index) and the a$ (forming a bearish triangle over the last few weeks, see my blog at http://www.fxa.com/solin/comments.htm). Though no new lows in gold are favored, declines in these other markets will likely at least weigh on gold ahead. Note too that lots of resistance lies just above recent highs in the $1265/70 area (50% retracement and bear trendline from the July high at $1345, 38% retracement from the March high at $1392), a potential area to form at least a temporary top. Nearby support is seen at the bullish trendline from the lows (currently at $1233/36). Bottom line: though a bigger picture bull, risk is rising for at least a week or more of correcting/consolidating lower.

Strategy/position:

Want to be long but just too much near term risk of a pullback to chase the market higher from here.

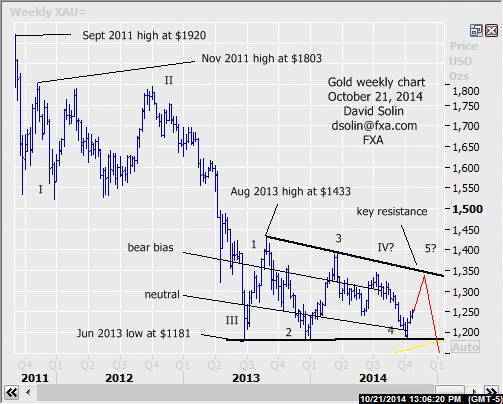

Long term outlook:

The market did indeed bounce from that long discussed $1185 area as the large triangle/pennant since June 2013 continues form. These are seen as continuation patterns suggesting an eventual downside resolution. However, they break down into 5 legs and "ideally" targets gains to the ceiling/bearish trendline from Aug 2013 first (currently at $1345/55, see in red on weekly chart/2nd chart below). Note too that the seasonal chart is generally higher through the end of the year (see 3rd chart below), while there is some chance for a more substantial pullback in the US$ (see earlier sent email), with both supporting the view of gains to that ceiling within the larger triangle pattern. Bottom line: long discussed triangle since June 2013 forming, scope for final upleg to ceiling (currently at $1345/55).

Strategy/position:

With gains to the ceiling of the triangle favored, want to switch the longer term bias to the bullish. But as with the shorter term above, too much risk for a near term pullback so would be bit more patient before switching from neutral.

Current:

Nearer term: want to be long but too much near term risk of a pullback to chase here.

Last: short Sept 2nd at $1265, took profit Oct 2nd at $1213 ($52 profit).

Longer term: gains to ceiling of large triangle favored, look for lower levels over next few wks to enter.

Last: bearish bias July 24th at $1300 to neutral Oct 10th at $1221.

Gold

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.