Good morning traders.

Here are mythoughts/forecasts looking ahead over the next 12-24 hours.

Quote of The Week: Trade what you see not what you think.

Note: the Intra-Day FX Forecastshighlight price direction and likely price targets/stops designed for traderslooking at trading opportunities over the next several hours. These are not official traderecommendations, merely guidelines and forecasts, which are pretty darn usefuleach trading day.

Intra-Day FXForecasts:

- Dollar Index (DXC): Bullish no change from yesterday: full steam ahead after a successful move higher above key Fib resistance last week (97.42). Near-term target seen at 99.45+ as long as prices hold above 98.14

- EUR/USD: Bearish from yesterday, remains valid: the move higher off of Friday's low at 1.0706 is clearly corrective. Prices are testing the minimum Fibonacci resistance level at 1.0792 and price action looks labored. Below 1.0753 suggests a new leg lower towards 1.0700 and lower

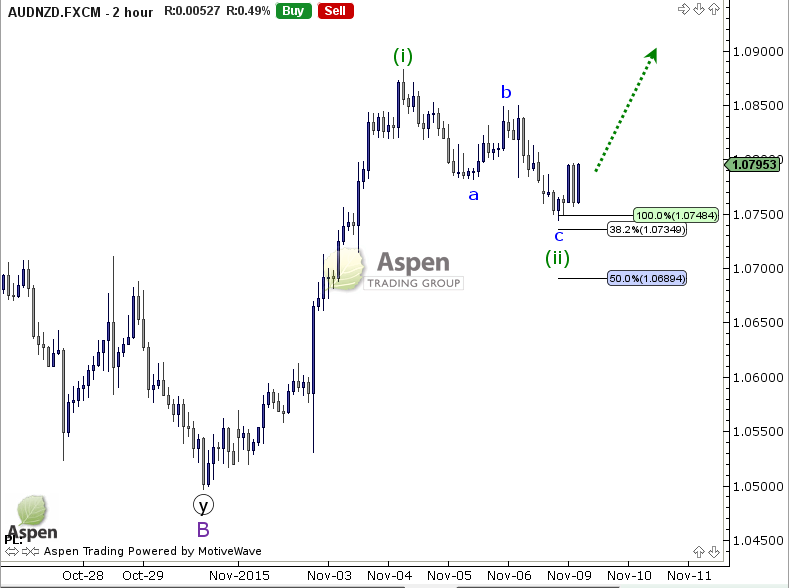

- AUD/NZD: Cautiously Bullish using the chart below as the backdrop for my bullish outlook, we simply need to be patient and wait for the Wave (ii) correction to complete.

- EUR/GBP: Bearish last week's spike higher was only in 3-waves and that suggests the move will not be sustained. Prices are already moving lower and a break below .7040 points to lower levels.

- NZD/CAD: Bearish looks like a triangle has developed here over the last few days and it suggests lower levels once complete. As of now I would be looking at a break below .8640 to kick the downside momentum into gear towards .8456 in the days ahead.

Dave

Aspen Trading Group´s FX Commentary, including any content or information contained within it or Aspen Trading Group´s web site, any site-related service, is provided “as is”, with all faults, with no representations or warranties of any kind, either expressed or implied, including, but not limited to, the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. You assume total responsibility and risk for your use of Aspen Trading Group´s commentary/website, site-related services, and hyperlinked websites.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.