The main reason behind oil's fall since the mid-2014 is global over-supply and lower demand. Thanks to new technology, allowing easier and more sustainable production (especially in the US), there has been increased production worldwide. Since 2008 WTI oil production rose by nearly 90%! In addition, OPEC countries are not taking their foot off the throttle, they continue to produce oil adding to supply. The lower-demand is due to economic slowdowns in China and Europe.

We must consider that WTI oil is priced in USD hence any news affecting the value of USD will impact the price of WTI oil. The FOMC press statement this evening is expected to shed some light on when interest rates will be raised by the Fed. If comments hint that rates are set to raise as early as December we may see further downward pressure on oil, but if comments are dovish leading investors to believe that rates will not rise so soon, oil may make some come-back.

Volatility is also an important factor for oil traders. The Oil Volatility Index (OVX) chart indicates the 30-day expected volatility for WTI oil. The current level, shown in the chart below, is 39.94% which means oil is expected to move 2.5% daily on average in the next 30 days. As you can see from the chart, this is a very high level of volatility, only once in the last three months has this level been exceeded (around July 8th).

In order to trade the WTI oil Futures contract and withstand this daily expected volatility, you may need to use a wider stop-loss and/or add more margin funds to your portfolio.

An alternative trade used in volatile markets is buying WTI oil option contracts. Through buying options you may trade a rising or falling oil price on limited risk and high leverage.

If you believe the price of oil will begin to rise, you may buy a Call option and if you believe the price of oil will continue to decline, you may buy a Put option.

Buying a Call option allows you to take advantage of an uptrend because a Call gives you the right to buy at a certain price over a certain period of time. A Call trade, with the right to buy 100 barrels of oil, at $50 over the next 14-days (expiry) costs 110 USD. If the price of oil rises above $50, the option's profit will grow. If oil does not rise by expiry a loss will be incurred, the loss is limited to the premium paid to buy the option (110 USD).

Buying a Put option allows you to take advantage of an downtrend because a Put gives you the right to sell at a certain price over a certain period of time. A Put trade, with the right to sell 100 barrels of oil, at $49 over the next 14-days (expiry) costs 130 USD. If the price of oil falls below $49, the option's profit will grow. If oil does not fall by expiry a loss will be incurred, the loss is limited to the premium paid to buy the option (130 USD).

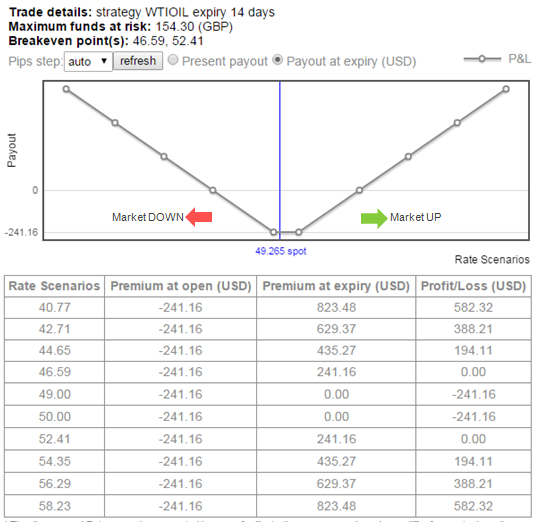

Buy a Call and a Put at the same time allows you to take advantage of a move in either direction. In the case that you have no indication of direction but you expect the price to become more volatile. If you were to buy the Call and Put examples as mentioned above, it would cost you a total of 240 USD (110 USD + 130 USD). If the price of oil moves above $50 by expiry the Call will payout and if the price of oil moves below $49 the Put will payout.

To be in profit the payout must cover the cost to buy the options by expiry, that is 240 USD. Hence, a profit will be made by expiry if oil price moves above$ 52.40 (Calls strike $50 + option's cost per 1 barrel of oil $2.40) or oil price moves below $46.60 (Put's strike - option's cost per 1 barrel of oil = $49 - $2.40). You can view profit or loss of this strategy over a range of oil prices from the Scenarios trading tool available via ORE's Web-platform

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.