The US dollar remained buoyant overnight alongside moderate gains in US equity markets and perhaps a few hawkish words from a Fed president for good measure. Following on from a solid 2015, the Dollar continues to drive off interest rates and the premise that the Fed will increase 3-4 times in 2016. Fed Richmond President Jeffrey Lacker reiterated his view that the Fed should hike 4 times in 2016. Lacker is not a voting member of the FOMC. Whatever the case, it certainly doesn’t bode well for the antipodean currencies, with the Aussie and Kiwi’s fortunes closely tied to dollar-demand among other dominate directives at the moment, such as China.

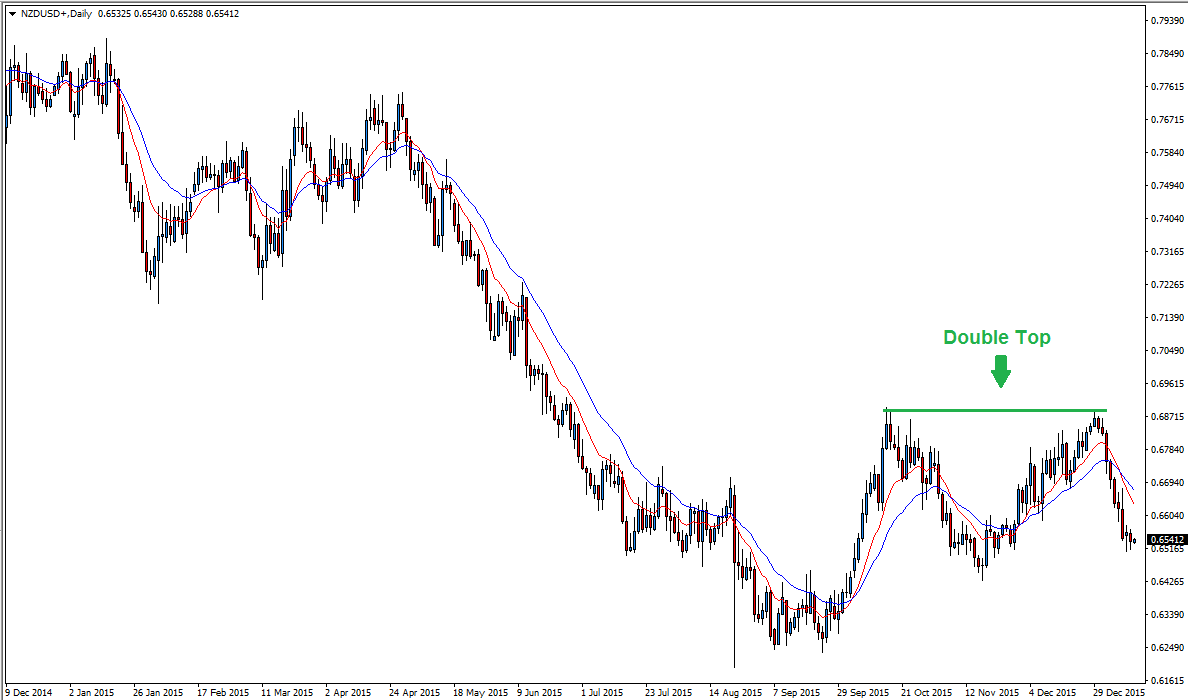

According to GO Markets analyst Adam Taylor, bearish prospects around the Kiwi are greater despite today’s reprieve. Certainly the technicals suggest as much. “A double top formed late December last year and since then the price has seen a steep decline. The moving averages are hinting at further bearish momentum and should the downtrend progress, we could see an initial test of 0.6475 with a longer-term target in the region of 0.6300. At the time of writing, key resistance appears to be located at 0.6650.”

Daily Chart – NZDUSDMoving on to the Australian dollar, and we’ve seen moderate demand this morning with price action clawing back above 70 US cents. Today’s job vacancies data was also seen to be a good pre-cursor to tomorrow’s official employment stats. According to the Australian Bureau of Statistics, total job vacancies in November 2015 increased by 3.1% from August 2015.

Chinese trade data saw a little jump from the local unit with a surprise jump in exports in December. The trade balance came in at 382bn in Yuan terms, against the 338bn expected. Exports rose 2.3% against an expected fall of -4.1%. Imports declined 4% against -7%.

Although we didn’t see any material move higher from the Aussie, the fact that we’ve seen a moderate bid tone is a good barometer of sentiment out of the region. At the time of writing the Australian dollar is buying 70.4 US cents.

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.