The fortunes of the world’s second largest economy have remained a key directive for global markets overnight. Yesterday’s material losses from Chinese stocks (and subsequent closure of the stock exchange) had set the scene for a decidedly negativity demeanour. Still, Chinese stocks have somewhat regained composure today, in-turn we’ve seen a moderate comeback across risk assets.

Overall, recent days have seen currencies dominated by the Japanese Yen – a clear sign that all is not well in the world given the JPY’s appeal spikes when the going gets tough.

Take for example its performance against the Aussie dollar. It’s moved a staggering 7 big figures since the first day of trade this year and is threatening to sink through the August 2015 lows just below 82-figure. A similar theme of Yen strength has played out across its major counterparts – and it’s clear the Bank of Japan are not going to be too enthused.

Billionaire investor George Soros, has chimed in with a little negative commentary noting the current state of play smells a bit like the 2008 crisis all over again… let’s hope he’s wrong. Certainly, markets do factor in extreme case scenarios, so for some, a period of sustained weakness could represents value.

To take a little of the guess work out, let’s have a brief look at a couple of technical views. Starting with the AUSUSD pair, our analysts have noted the pair has largely respected the 22 day exponential moving average when view it on an hourly basis. The move above the 22 day EMA (which occurred this morning) is perhaps a sign of a bullish reversal. Although the 70 US cent level was breached overnight, one may expect it to provide some psychological support unless we see leading directives like China and commodities experience a material downturn once again.

AUD Hourly Chart – breach of 22 day EMAOn the domestic front, retail sales data this morning spurred a moderate comeback from the Aussie, with November’s data suggesting Australian’s were happy to loosen the purse strings a little ahead of Christmas. Some analysts have suggested it is perhaps a result of a string of positive employment numbers in recent months.

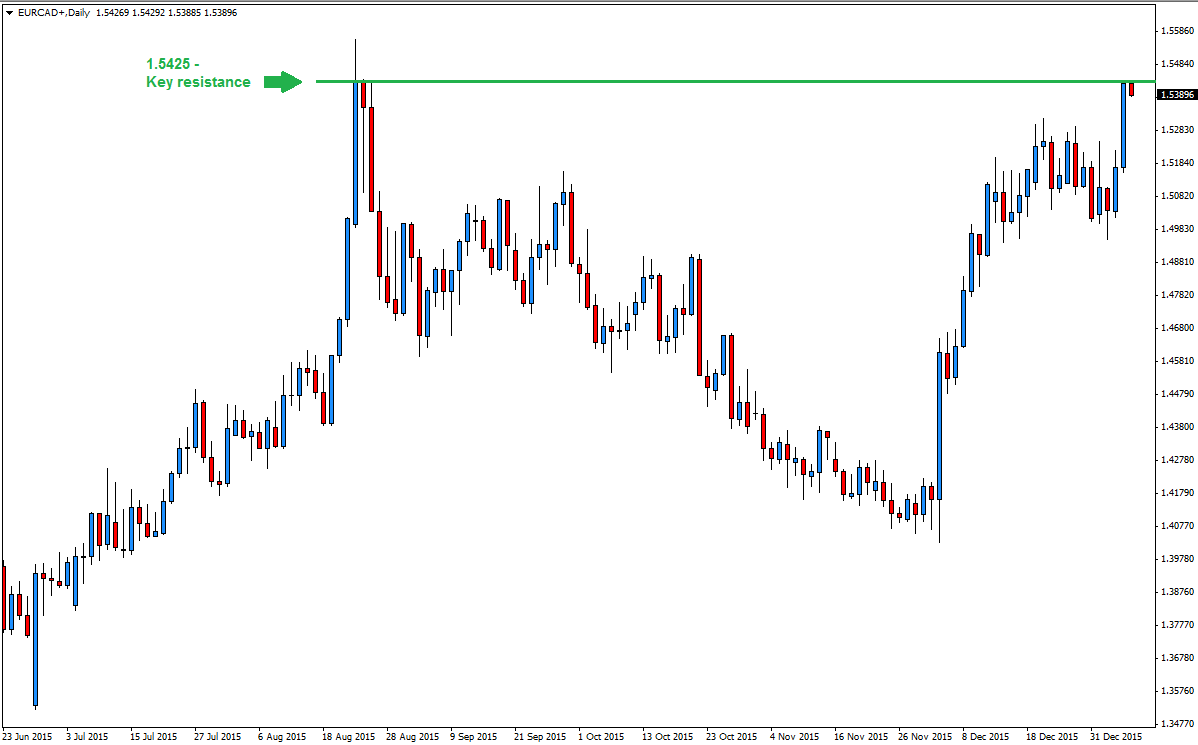

Looking the Euro, and its performance against the Canadian dollar (daily chart) shows technical signs worth considering. Certainly if we are looking for resistance, history shows a behavioural tendency for levels around 1.5425 to act as a cap. Stop entries set above this figure may very well capture a stronger recovery for which the 1.59 highs last seen in 2010 looks like a reasonable target.

With what is shaping up to be a reasonable day from Chinese markets, the focus will turn to jobs data out of the US today. Clearly, the NFP’s are being looked at in the context of the Fed’s next move on rates, for which markets expecting subsequent increases in 2016. This sentiment was backed up by the Fed’s Williams earlier this week who said he expects 3 – 5 increases this year. Payrolls are expected to gain 200K in December against 211K for the previous month, with the official unemployment rate expected to remain unchanged at 5 percent. A solid jobs number is the Greenbacks best chance to take another leg higher.

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.