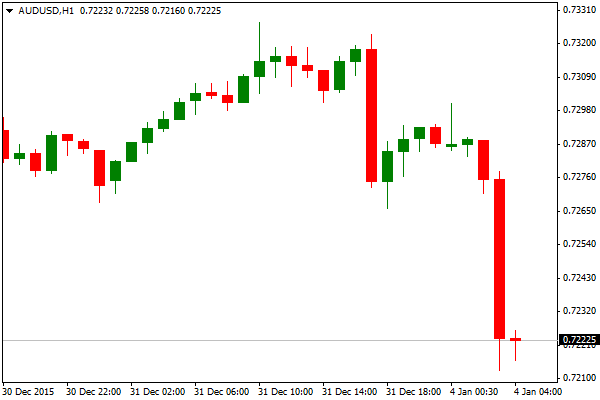

The US dollar has kicked off the year in solid form against its major counterparts. Judging by both USD and JPY movements, the balance of risk appears to be falling on the side of caution amid escalating tensions the Middle East as Saudi Arabia cuts its diplomatic ties to Iran. Furthermore, a magnitude 5.1 Earth quake in New Zealand may have prompted a little more (temporary) weakness for the Kiwi and residual weakness for the A$. Still, it does appear to be Middle Eastern issues that are the primary catalysts, and naturally high beta currencies are the first to fall.

Of course, it’s worth looking at the steep drop across Asian markets which is – in part – responsible for the poor performance from the antipodean currencies. Less than inspiring Chinese PMI is all the talk around the traps this morning with the Caixin/Markit manufacturing purchasing managers index recording a drop to 48.2 in December, down from 48.6 in November. Expectations were for around the 48.9 level. The Aussie and Kiwi are down around 0.9 and 0.8 percent respectively on the day.

AUD takes a hit on China / Geopolitical TensionsAs liquidity begins to return, there’s plenty to keep market participants interested this week, and certainly the US Dollar/US rates dynamic remains a key theme. We’ve seen a rate hike in the US and now it’s time for the US economy to both justify the rate hike and show cause for more, in accordance with market expectations. For this, participants are looking to this Friday’s US non-farm payrolls for inspiration among a raft of high to mid-tier US data through the week which we will be covering in tomorrow’s report.

Locally, as the RBA are taking a breather this month, the focus will be on trade, housing and retail sales data. Without any major local themes, one may expect the Aussie fortunes will rest on what’s happening abroad, with geopolitical risk, China, and further US rates conjecture likely to be the primary directives.

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.