The US dollar has kicked of the week well bid after receiving a bump on Friday’s US jobs data. After a bit volatility that is. Still, the sort of volatility after the Non-farm Payrolls pales in significance to last week’s European Central Bank reaction, which saw the Euro clean up against the greenback. Perhaps the ECB volatility and subsequent Euro strength has squeezed market participants and help moderate what should have been a whole lot movement after the NFP’s.

Whatever the case, the US economy has passed a critical test, and a better than expected jobs print is a tick in favour of argument that the Fed are poised to increase rates on December 16. Markets will get more chances to gauge the performance of the US economy this week with Friday’s Retail Sales and University of Michigan consumer confidence data, among other mid-tier themes throughout the week.

This week its Australia’s turn with November’s unemployment data on Thursday’s docket, but the implications are in reverse. Market participants are of course looking at the domestic data flow in the context of rate cut in 2016. Early forecasts suggest the official unemployment rate my edge up to 6 percent from 5.9 in September. Still, the domestic economy has a habit recently of upside surprises with solid exports and GDP data last week keeping the Aussie well bid, notwithstanding further losses in commodities. It’s worth looking at the Aussie’s recent lack of correlative value with commodities.

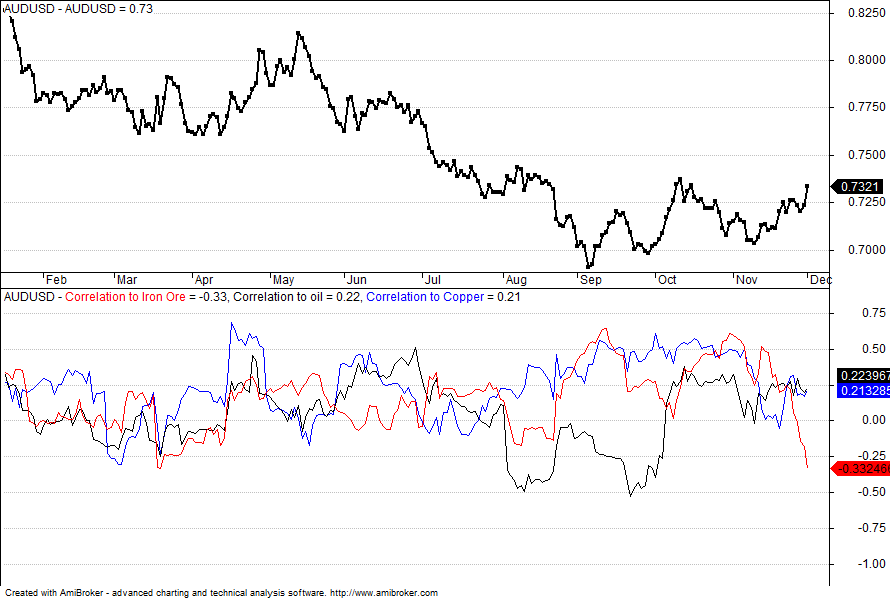

If we take a look at the top section of the chart below, it shows the price of Australian Dollar and bottom section shows the 20 day (approx. one calendar month ) rolling correlation between net changes in daily AUDSUD with net daily changes in prices of Brent oil (Black Line), Copper (blue line) and Iron Ore (Red Line).

As you can see, since the start of November this year, Aussie’s connection with the price of those commodities has noticeably weakened. Of interest is now the negative correlation that now exists between the currency pair and the Iron Ore.

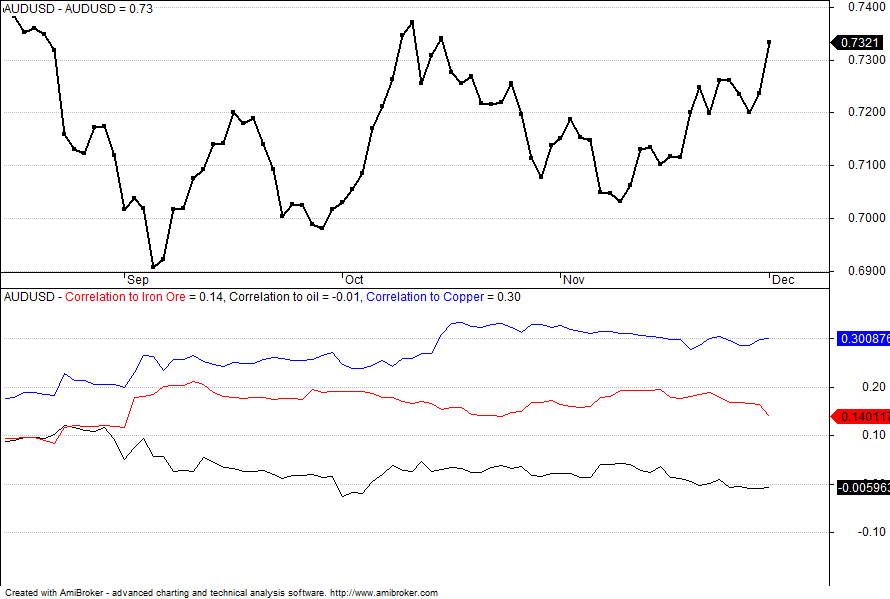

To get a better picture with a longer term view, we changed the correlation parameter to 126 (approximately 6 months) days. As you can see, even from a longer term point of view Australian dollar is becoming less sensitive to the price of commodities.

Given markets are forward looking; this means that the expected future negative outlook for commodity prices might have already been priced in. It also means that traders need to be more focused on Australian domestic monetary and economic conditions (e.g .rates, unemployment, CPI, Business activity in general) rather than commodity activities.

Still it’s worth pondering the ability for a material correction in commodities to shock the correlation back into play, which perhaps lends itself to the view that the Aussie has some catching up to do.

Current market snap shot and Net change

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.