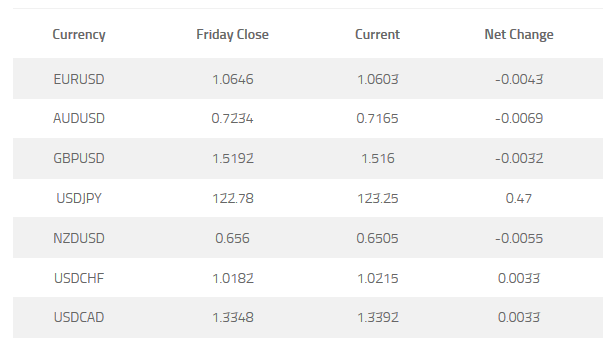

Key to the US dollar’s direction this week a full deck of economic data. It’s all rates in the U.S and clearly any data point which points to the upside, the greater the chance the Fed will increase rates in December. The dollar consolidated recent gains throughout last week, and solid data will represent a good opportunity for a pre-Fed rally, despite the fact its Thanksgiving week which will see lower volumes. We’re already seeing markets bid the dollar higher in the domestic session, with gains across ALL major counterparts.

Highlights this week include manufacturing PMI and existing home sales on Tuesday. Trade balance, 3Q gross domestic product and consumer confidence data on Wednesday. Thursday’s releases include, personal income and spending, consumption expenditure and durable goods orders, new home sales and University of Michigan consumer confidence. Refer to the GO Markets website for a full list of economic data this week.

If you value the opinion of Goldman Sachs, in a research piece released last week their economists’ are making a case for the Fed to start increase rates in December and expect 100 basis points to be added to the Federal Funds Rate in 2016. Given money markets are factoring 55-60 basis points, this view would suggests the greenback still has some legs yet. Although they do concede “the risks to this forecasts as skewed to the downside at the moment.” Read more at the Calculated Risk website.

The thematic remains quite the opposite across the Atlantic, with markets predicting when the European Central Bank will add more stimulus and take deposit rates deeper into negative territory. ECB President Draghi’s mantra is the ECB will do ‘whatever it takes’ to bring inflation back to acceptable levels, and didn’t sway from this commitment once again last week. The Australian covers Draghi’s latest comments in detail.

Much of this week’s data from the European region will be from Germany. Starting with Manufacturing and Services PMI on Monday, market participants will get a view of the health of Europe’s largest economy with GDP and IFO data on Tuesday and retails sales on Friday.

Locally, there’s not a great deal of top tier data on the agenda this week with Thursday’s 3Q Capital Expenditure (Capex) data generally a closely watched data point. The level of investment activity indicated by the Capex data serves as a barometer of sentiment about the economy. It may also provide an indication of confidence in new leadership with Prime Minister Malcolm Turnbull taking over the reins from Tony Abbott in September.

Certainly, there will be some interest around speeches from the RBA’s Glenn Stevens in Sydney, and Guy Debelle in London. At the time of writing the Australian dollar is buying 71.65 US cents.

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.